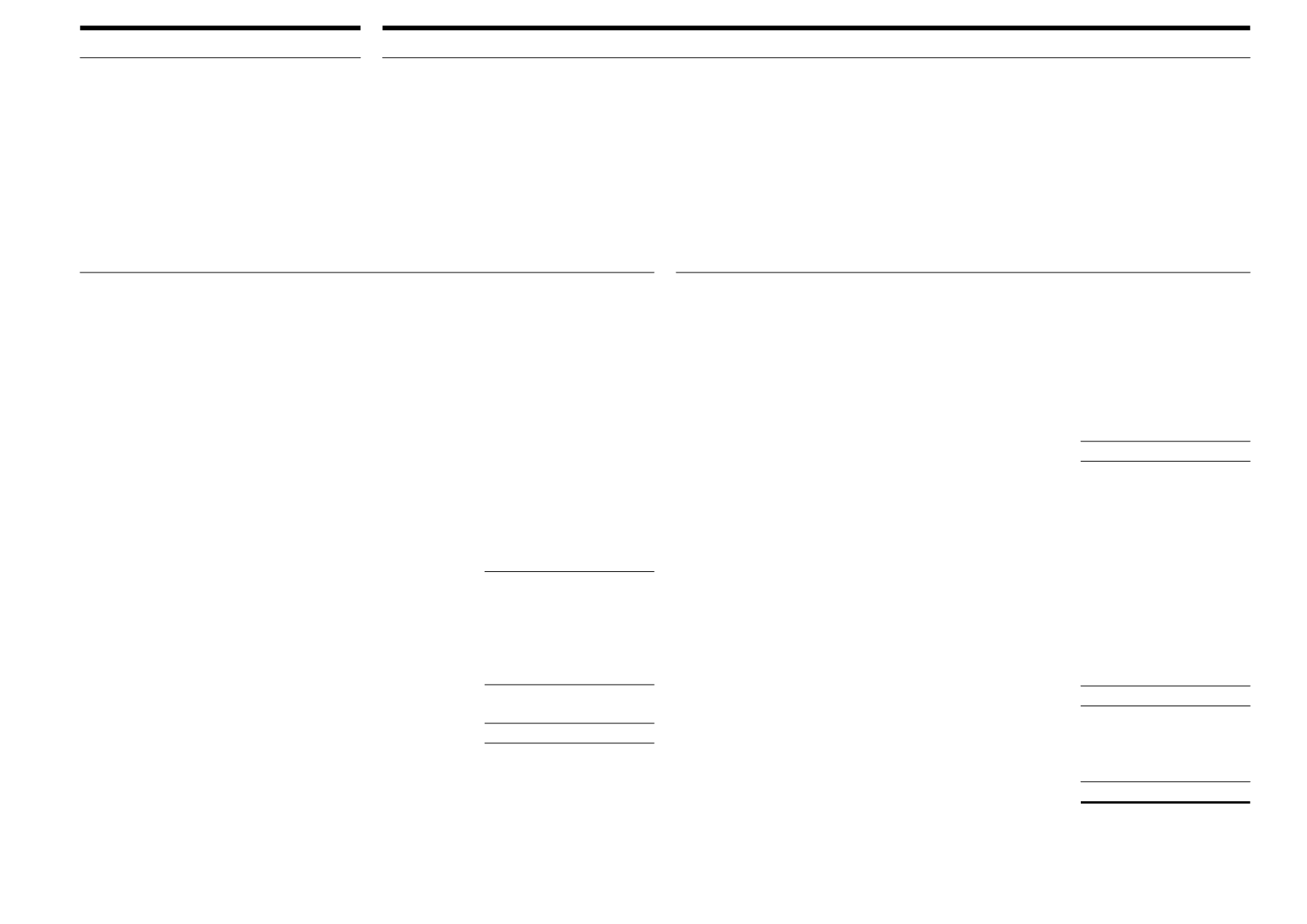

44

TEHO INTERNATIONAL INC LTD.

Annual Report 2015

Group

2015

2014

$

$

Cash flows from operating activities

(Loss)/Profit before tax

(7,456,501) 3,387,639

Adjustments for:

Allowance for impairment on trade receivables, net

464,728

13,375

Allowance for foreseeable loss on development properties

788,108

–

Amortisation of intangible assets

521,000

588,000

Depreciation

1,560,991

990,258

Fair value (gain)/loss on derivatives

(16,283)

376,525

Gain on disposal of plant and equipment

(40,830)

–

Impairment loss on an associate

53,625

–

Impairment loss on goodwill

2,209,048

–

Loss on disposal of an associate

8,636

–

Net fair value gain on contingent consideration payable

(194,076)

–

Net finance costs

815,975

378,613

Share of loss/(profit) from associates, net of tax

51,212

(27,729)

Operating cash flows before changes in working capital

(1,234,367) 5,706,681

Changes in:

- Inventories

(2,144,122)

(839,955)

- Development properties

1,070,672 5,115,579

- Trade and other receivables

1,240,733 (5,290,471)

- Trade and other payables

374,771 2,721,416

Cash (used in)/generated from operations

(692,313) 7,413,250

Tax paid

(588,118)

(355,502)

Net cash (used in)/from operating activities

(1,280,431) 7,057,748

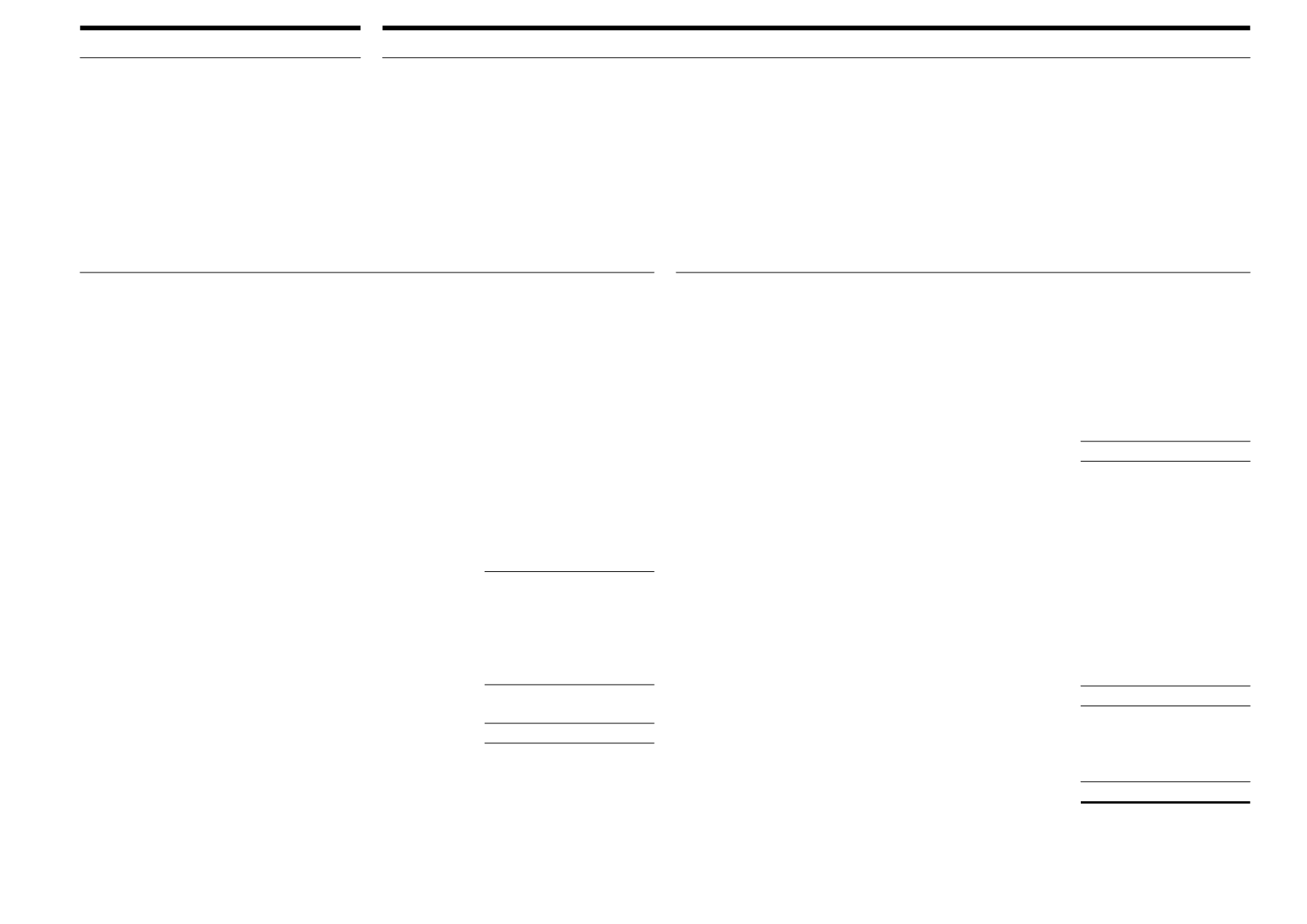

Group

Note

2015

2014

$

$

Cash flows from investing activities

Acquisition of property, plant and equipment

(2,239,772) (1,062,352)

Acquisition of subsidiary, net of cash acquired

27 (2,923,986) (3,482,270)

Payment of contingent consideration

16

(450,000)

–

Dividend received from associates

–

13,507

Interest received

2,741

2,007

Proceeds from disposal of plant and equipment

47,732

–

Proceeds from disposal of an associate

121,250

–

Net cash used in investing activities

(5,442,035) (4,529,108)

Cash flows from financing activities

Cash restricted in use

–

12,000

Contributions from non-controlling interests

183,762

–

Dividends paid to owners of the Company

(1,523,740)

(709,146)

Interest paid

(1,679,104)

(435,053)

Payment of finance lease liabilities

(173,030)

(156,653)

Proceeds from loans and borrowings

15,647,902 13,000,000

Proceeds from issue of ordinary shares

– 4,254,877

Repayment of loans from directors of a subsidiary

(2,914,459)

–

Repayment of loans and borrowings

(5,109,379) (7,590,024)

Share issue expense

–

(154,437)

Net cash from financing activities

4,431,952 8,221,564

Net (decrease)/increase in cash and cash equivalents

(2,290,514) 10,750,204

Cash and cash equivalents at beginning of the year

15,800,623 5,056,521

Effect of exchange rate fluctuations on cash held

221,596

(6,102)

Cash and cash equivalents at end of the year

11 13,731,705 15,800,623

* See Note 9 for disclosure on significant non-cash transaction.

The accompanying notes form an integral part of these financial statements.

CONSOLIDATED STATEMENT

OF CASH FLOWS

Year ended 30 June 2015