96

TEHO INTERNATIONAL INC LTD.

Annual Report 2016

NOTES

TO THE FINANCIAL STATEMENTS

Year ended 30 June 2016

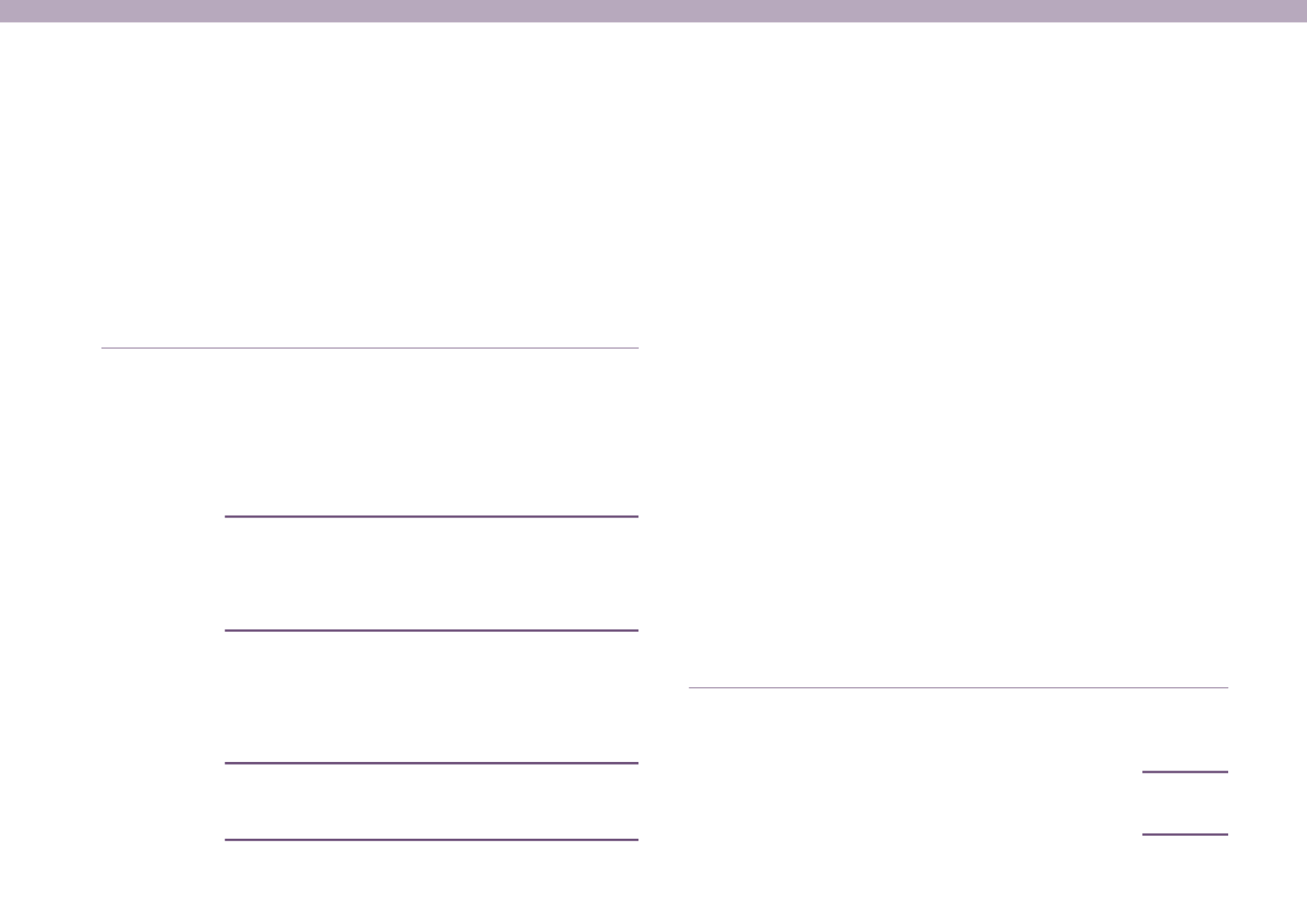

29 FINANCIAL INSTRUMENTS: INFORMATIONON FINANCIAL RISKS (CONT’D)

Liquidity risk (cont’d)

Carrying Contractual Less than 1 – 5

Over

amount cash flows

1 year

years

5 years

$

$

$

$

$

Group

Derivative

financial liabilities

30 June 2016

Net settled:

Structured

currency

instruments

40,764 (40,764)

(40,764)

–

–

30 June 2015

Net settled:

Structured

currency

instruments

360,241 (360,241)

(360,241)

–

–

Company

Non-derivative

financial liabilities

30 June 2016

Trade and other

payables

38,936,968 (39,114,181) (37,810,848) (1,303,333)

–

30 June 2015

Trade and other

payables

30,798,477 (31,435,689) (29,672,356) (1,763,333)

–

* Excludes derivatives (shown separately) and advance receipts from customers.

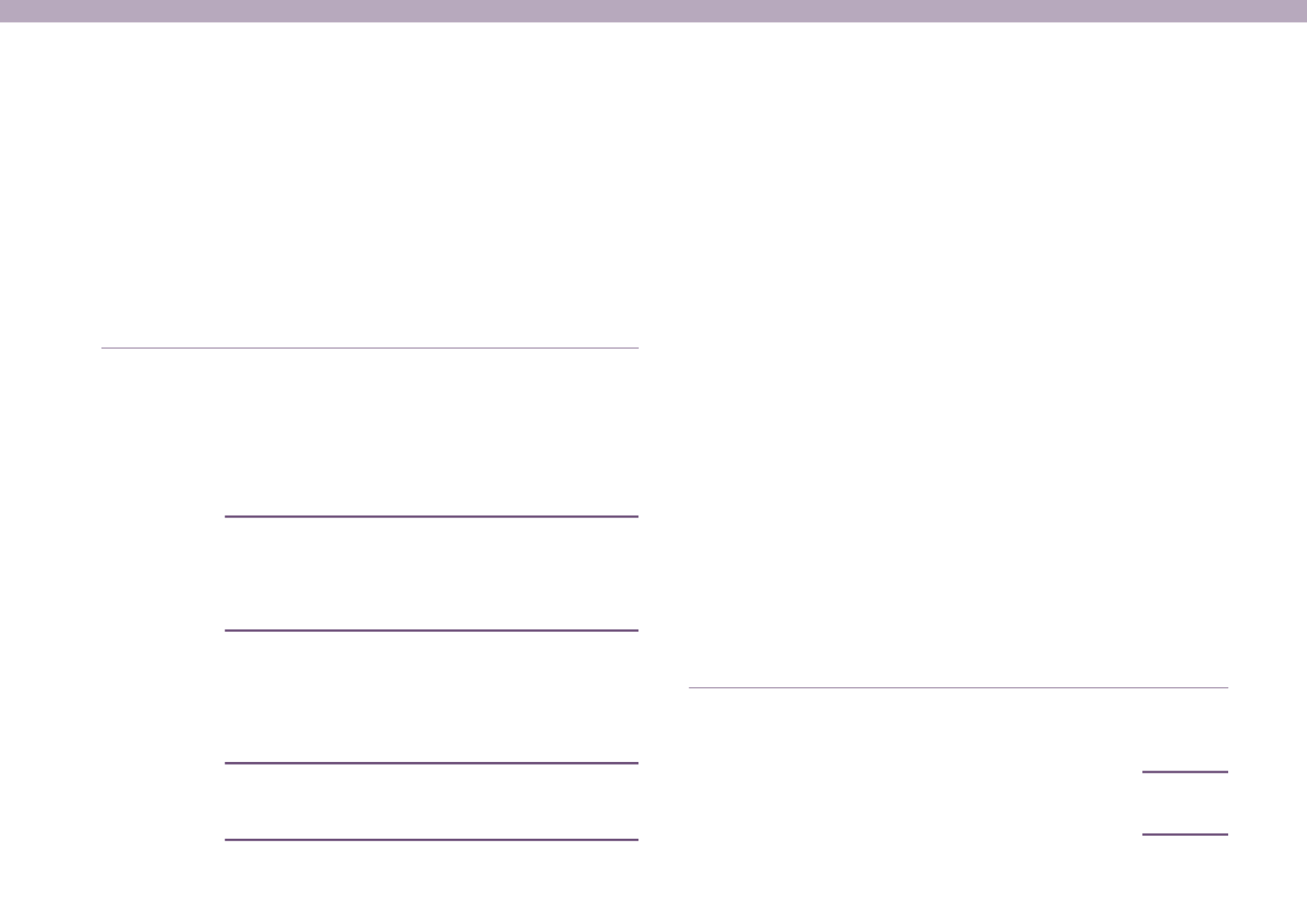

29 FINANCIAL INSTRUMENTS: INFORMATIONON FINANCIAL RISKS (CONT’D)

Liquidity risk (cont’d)

The above amounts disclosed in the maturity analysis are the contractual undiscounted

cash flows and such undiscounted cash flows differ from the carrying amounts included

in the statement of financial position. The undiscounted amounts on the borrowings

with variable interest rates are determined by reference to the conditions existing at

the reporting date. When the counterparty has a choice of when an amount is paid, the

liability is included on the basis of the earliest date on which it can be required to pay.

It is expected that all the liabilities will be settled at their contractual maturity.

The classification of the financial assets is shown in the statement of financial position as

theymay be available tomeet liquidity needs and no further analysis is deemed necessary.

Financial guarantee contracts

For financial guarantee contracts the maximum earliest period in which the guarantee

would be called is used. As at 30 June 2016 and 2015, no claims on the financial

guarantees are expected. The following table shows the maturity analysis of the

financial guarantees.

Less than

1 year

$

Company

2016

Corporate guarantees in favour of subsidiaries

43,700,716

2015

Corporate guarantees in favour of subsidiaries

62,533,404