Financials

Financial Statements And Related Announcement - Half Yearly Results 2026

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

-

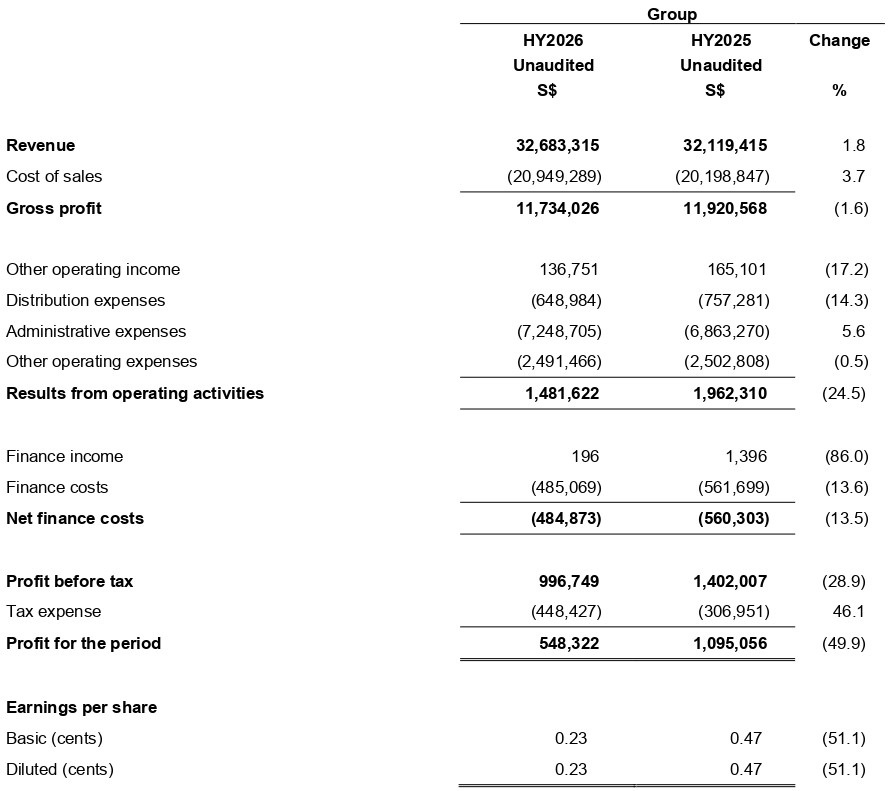

CONDENSED INTERIM CONSOLIDATED STATEMENT

OF PROFIT OR LOSS

Notes:

(1) HY2025: 6 months ended 31 December 2024

(2) HY2026: 6 months ended 31 December 2025 -

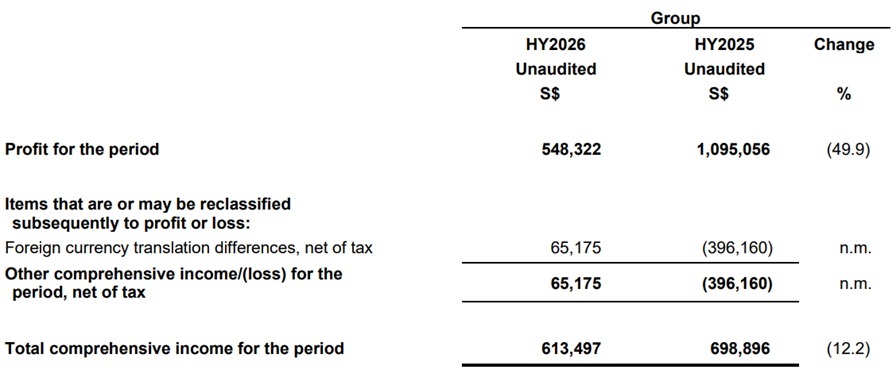

CONDENSED INTERIM CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

Note:

n.m.: not meaningful -

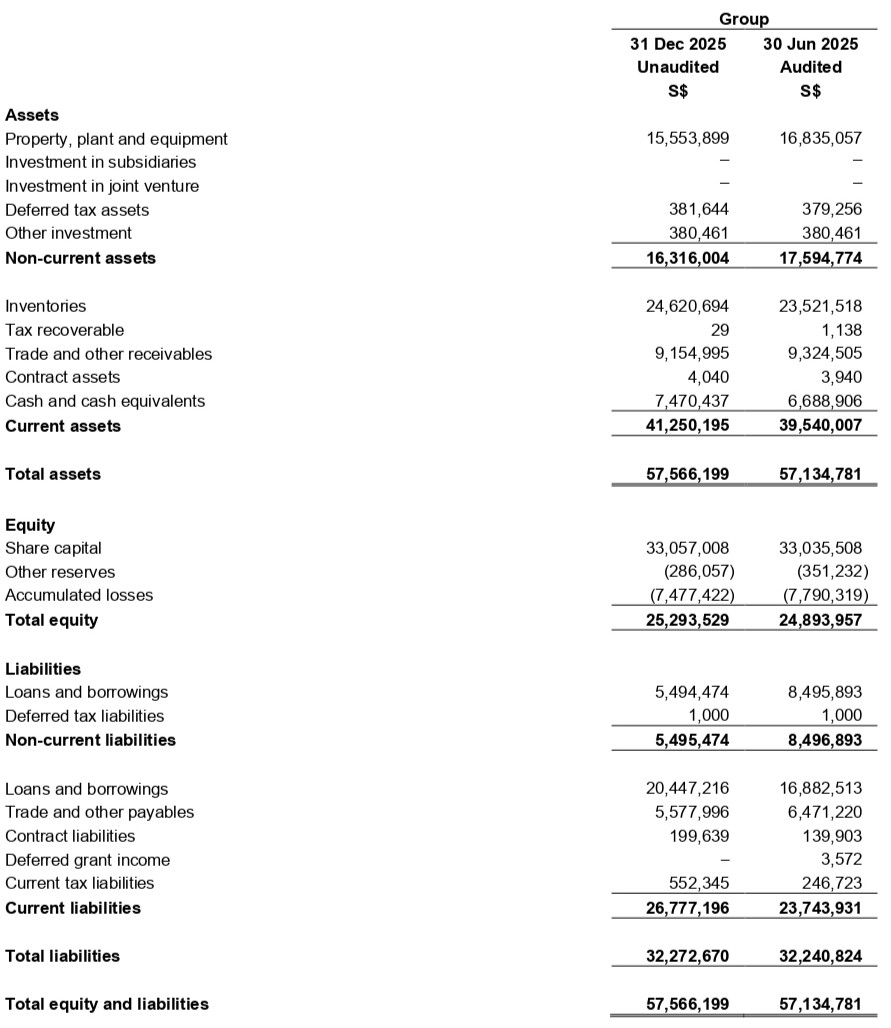

CONDENSED INTERIM STATEMENTS OF FINANCIAL

POSITION

-

FINANCIAL PERFORMANCE REVIEW

Revenue

Revenue increased by S$0.6 million or 1.8% to S$32.7 million for the financial period from 1 July 2025 to 31 December 2025 (“HY2026”) from S$32.1 million for the financial period from 1 July 2024 to 31 December 2024 (“HY2025”).

- Marine & Offshore Segment revenue increased by S$1.6 million or 5.5% in HY2026 as compared to HY2025. This was mainly due to the increase in revenue contribution from the mooring and rigging business, arising from the delivery of orders received for newly-built vessels and the completion of existing contractual orders during the period.

- Others Segment revenue fell by S$1.0 million or 43.3% in HY2026 as compared to HY2025. The decrease was mainly due to the lower contributions from water and environmental treatment business by S$0.9 million and property consultancy business by S$0.1 million. This decline also led to reduction in the cost of sales for this segment.

Gross profit

The Group’s gross profit of S$11.7 million in HY2026 decreased by S$0.2 million or 1.6% compared to HY2025. The Group’s gross profit margin slightly decreased to 35.9% in HY2026 from 37.1% in HY2025.

- Marine & Offshore Segment contributed gross profit of S$11.0 million to the Group in HY2026 as compared to S$10.7 million in HY2025. Despite the increase in revenue, the gross profit margin decreased to 35.1% in HY2026 from 36.3% in HY2025, mainly due to lower margins in the mooring and rigging business to remain competitive under current market conditions.

- Others Segment contributed gross profit of S$0.7 million to the Group in HY2026, comprising S$0.4 million from the water treatment business and S$0.3 million from the property consultancy business.

Other operating income

Other operating income decreased by S$28,000 to S$137,000 in HY2026 from S$165,000 in HY2025. The decrease was mainly due to decrease in grant received in HY2026.

Distribution expenses

Distribution expenses decreased by S$0.1 million or 14.3% to S$0.6 million in HY2026 from S$0.7 million in HY2025 due to lower freight costs as a result of easing in supply chain disruptions.

Administrative expenses

Administrative expenses increased by S$0.4 million or 5.6% to S$7.2 million in HY2026, due mainly due to (i) higher manpower costs arising from necessary salary adjustments to remain competitive in attracting talent, and (ii) increased professional fees incurred for legal and consultancy services.

Other operating expenses

Other operating expenses remained stable at S$2.5 million in HY2026, with no material changes compared to HY2025.

Finance income

Finance income, comprising mainly interest income from bank deposits, remained insignificant for HY2026.

Finance costs

Finance costs decreased by S$77,000 or 13.6% to S$485,000 in HY2026 from S$562,000 in HY2025, due to lower interest on bank loans in HY2026 compared to HY2025.

Income tax expense

The Group incurred an income tax expense of S$0.4 million in HY2026 as compared to S$0.3 million in HY2025. This increase was mainly due to higher profit contributions from TEHO Europe B.V., which is subject to a higher corporate tax rate in the Netherlands compared to Singapore.

Profit for the period

Combining the profit before tax of S$1.7 million from the Marine & Offshore Segment, loss before tax of S$0.3 million from the Others Segment and unallocated head office expenses of S$0.4 million, the Group’s profit before tax was S$1.0 million in HY2026 as compared to a profit before tax of S$1.4 million in HY2025. After accounting for income tax expense of S$0.4 million in HY2026, the Group’s net profit after tax for HY2026 amounted to S$0.5 million as compared to a net profit after tax of S$1.1 million in HY2025.

-

FINANCIAL POSITION REVIEW

Non-current assets

Non-current assets decreased by S$1.3 million to S$16.3 million as at 31 December 2025 from S$17.6 million as at 30 June 2025. The decrease of S$1.3 million was mainly due to the (i) depreciation of property, plant and equipment of S$0.9 million; (ii) the effect of movements in exchange rates for property, plant and equipment of foreign subsidiaries of S$0.1 million; and (iii) derecognition of right-of-use assets amounting to S$0.5 million, partially offset by acquisition of plant and equipment of S$0.2 million.

Current assets

Current assets increased by S$1.8 million from S$39.5 million as at 30 June 2025 to S$41.3 million as at 31 December 2025. The increase was mainly due to the following:

- Inventory increased by S$1.1 million from S$23.5 million as at 30 June 2025 to S$24.6 million as at 31 December 2025. This increase was attributed to proactive measures taken in anticipation of extended lead times for the supply of inventory within the Marine & Offshore Segment.

- Cash and cash equivalents increased by S$0.8 million from S$6.7 million as at 30 June 2025 to S$7.5 million as at 31 December 2025. Please refer to the “Cash Flow Review” section below for details.

The increase in current assets stated above was partially offset by decrease in trade and other receivables by S$0.1 million.

Non-current liabilities

Non-current liabilities decreased by S$3.0 million to S$5.5 million as at 31 December 2025 from S$8.5 million as at 30 June 2025. The decrease was due to reclassification of non-current term loans and lease liabilities to current liabilities as part of the scheduled repayment plans.

Current liabilities

Current liabilities increased by S$3.1 million to S$26.8 million as at 31 December 2025 from S$23.7 million as at 30 June 2025. The increase was mainly due to the following:

- Current portion of loans and borrowings increased by S$3.6 million, as a result of reclassification of long term loan to current liabilities as the loan falls due for repayment within the next twelve months.

- Current tax liabilities increased by S$0.3 million.

- Contract liabilities increased by S$0.1 million attributable to more advances received from customers.

The increase stated above was partially offset by decrease in trade and other payables of S$0.9 million, mainly due to slowdown in purchase of goods in December 2025.

Equity

As a result of the above and the granting of share awards to an employee in HY2026, total equity of the Group increased by S$0.4 million to S$25.3 million as at 31 December 2025 from S$24.9 million as at 30 June 2025.

-

CASH FLOWS REVIEW

The Group’s net cash flows generated from operating activities was S$0.4 million in HY2026 compared to net cash generated from operating activities of S$2.4 million in HY2025. The decrease was mainly due to lower profit before tax, along with higher inventory levels in the Marine & Offshore Segment’s business and decreases in trade and other payables.

Net cash flows used in investing activities amounted to S$0.1 million in HY2026, mainly due to the capital expenditure on the acquisition of property, plant and equipment.

Net cash flows from financing activities amounted to S$0.4 million in HY2026 was mainly due to proceeds from the drawdowns of bank loans and borrowings of S$9.9 million; partially offset by dividend payment of S$0.2 million, interest payment of S$0.5 million, repayment of loans and borrowings of S$8.4 million, and payment of lease liabilities of S$0.4 million.

As at 31 December 2025, the Group had cash and cash equivalents of S$7.5 million as compared to S$7.3 million as at 31 December 2024.

-

COMMENTARY

Recent developments in global trade, including the imposition of significant tariffs by various countries, have created an uncertain global economic outlook. These developments have heightened concerns over disruptions to global trade and supply chains, as well as rising costs for businesses and consumers. Against this backdrop, the Group maintains a cautious outlook for the next twelve months.

Accordingly, the Group remains focused on prudent cost management and operating discipline to ensure the sustainability of its businesses.