16

TEHO INTERNATIONAL INC LTD.

Annual Report 2015

OPERATIONS &

BUSINESS REVIEW

CURRENT ASSETS

Current assets increased by $20.3 million or

24.9% to $101.8 million as at 30 June 2015

from $81.5 million as at 30 June 2014. The

increase is due to the following:

• Inventories increased by $2.4 million.

Inventory turnover days in FY2015 increased

to 225 days compared to 204 days in

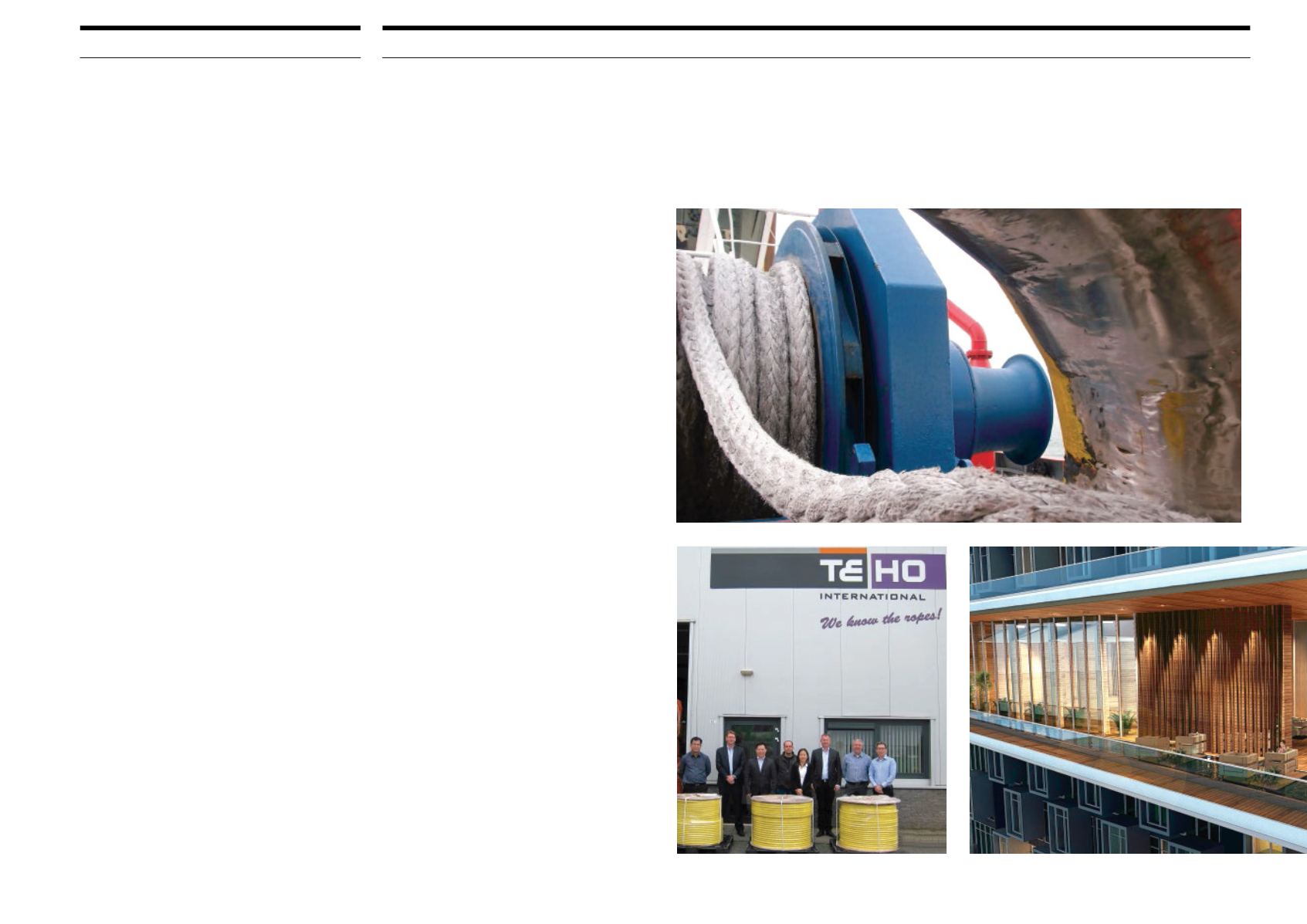

FY2014. The Marine, Offshore Oil & Gas

segment has been increasing its range of

products sold, including stocking up of

spare parts to meet customer demands.

• Development properties increased by $19.9

million, mainly due to recognition of the land

in relation to “The Bay” project contributed

by the Group’s non-controlling interests in

Cambodia.

• No material changes to trade and other

receivables.

• Cash and cash equivalents, including the

effect of exchange rate fluctuations on cash

held, decreased by $2.1 million. Please refer

to the “Cash Flows Review” section below

for details.

NON-CURRENT LIABILITIES

Non-current liabilities increased by $7.8 million

or 29.6% to $34.0 million as at 30 June

2015 from $26.2 million as at 30 June 2014.

The increase is due to the following:

• Non-current portion of loans and

borrowings increased by $7.5 million. The

Group drawn down additional term loans

during the year with a non-current portion

of $5.4 million at the end of FY2015. The

Property Development segment acquired

two properties funded by term loans with

a non-current portion of $2.8 million. These

were offset by repayments during the year

of $0.7 million.

• Deferred tax liabilities increased by

$0.2 million.

CURRENT LIABILITIES

Current liabilities increased by $5.7 million or

15.3% to $42.7 million as at 30 June 2015

from $37.0 million as at 30 June 2014. The

increase is due to the following:

• Current portion of loans and borrowings

increased by $5.9 million. The Group drawn

down additional short-term loans of $5.5

million and term loans with a current portion

of $1.0 million at the end of FY2015. The

current portion of the term loans obtained

by the Property Development segment for

two properties amounted to $0.1 million.

In addition, the Property Development

segment drawn down $2.1 million of loans

for the construction of properties in its

two development projects in Singapore.

These were offset by a loan repayment of

$2.8 million.

• Current tax liabilities decreased by

$0.2 million.