15

TEHO INTERNATIONAL INC LTD.

Annual Report 2016

Bay” project, and having considered the

market conditions in Phnom Penh and

other factors, the Group and its joint

venture partner have decided to put on

hold the residential development phase

of the project. The Group is currently

working together with its joint venture

partner in assessing the market changes

and repositioning the development

project. This has resulted in the

impairment loss in respect of goodwill

attributable to ECG.

The remaining $1.0 million increase in other

operating expenses is attributable to the

Marine & Offshore segment:

• Impairment loss in respect of goodwill

and investment in associate attributable

to the Marine & Offshore segment’s

subsidiaries in Singapore amounted to

$2.3 million. Due to the negative impact

of crude oil prices on the outlook of the

offshore oil & gas industry, the projected

cash flows to be derived from the

subsidiaries in the Marine & Offshore

segment was affected unfavourably,

thus, resulting in the impairment loss.

The increase was partially offset by:

• Foreign exchange losses decreased by

$1.2 million.

Other operating expenses also include the

following:

• Bad debts written off amounting to

$0.2 million relate to the Property

Development segment.

• Land rental amounting to $0.5 million

in FY2016 represents an increase of

$0.2 million from $0.3 million in FY2015.

The increase is mainly attributable to

expenses incurred to rent a parcel of land

in Cambodia to be used to build a show

flat for “The Bay” project.

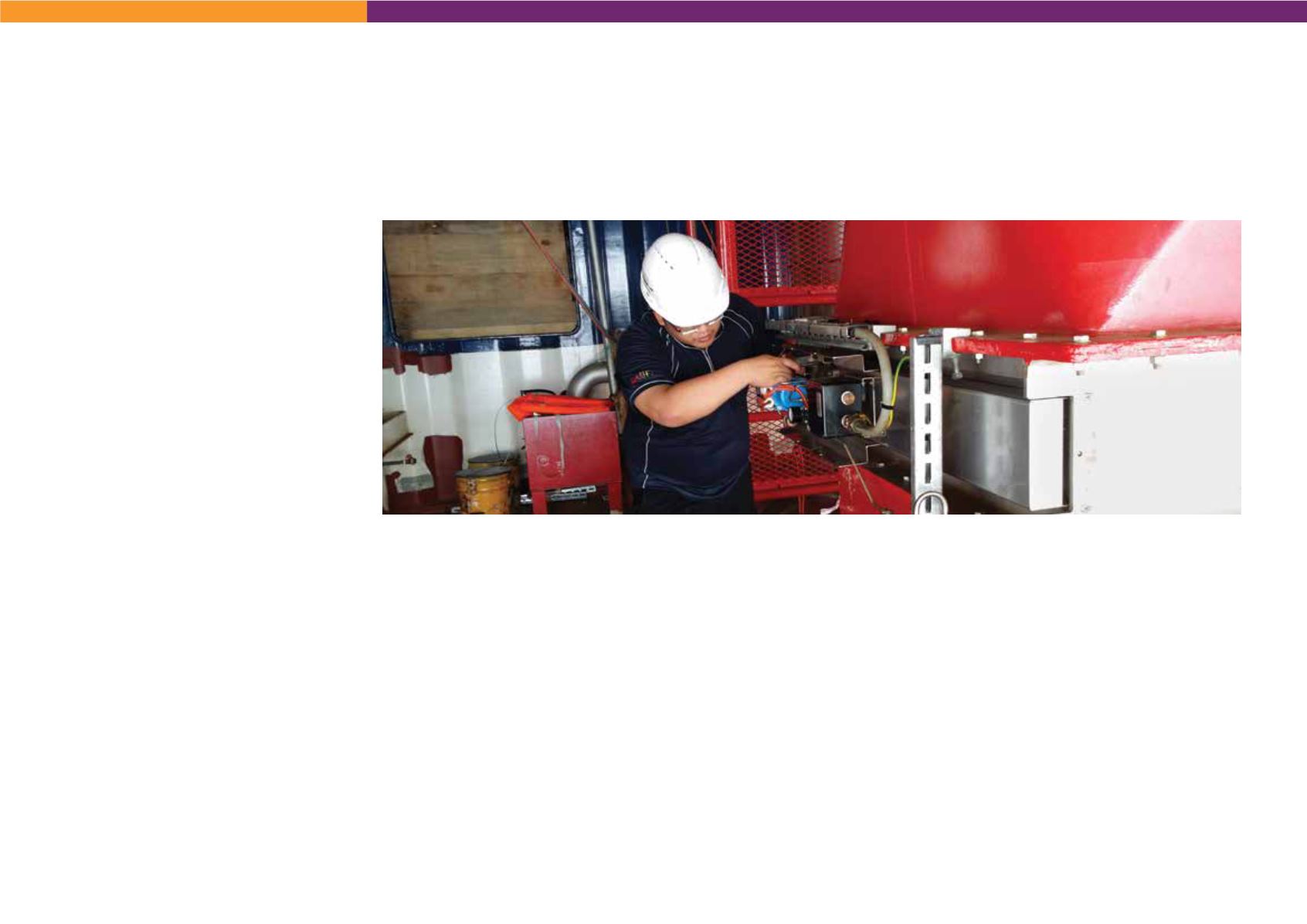

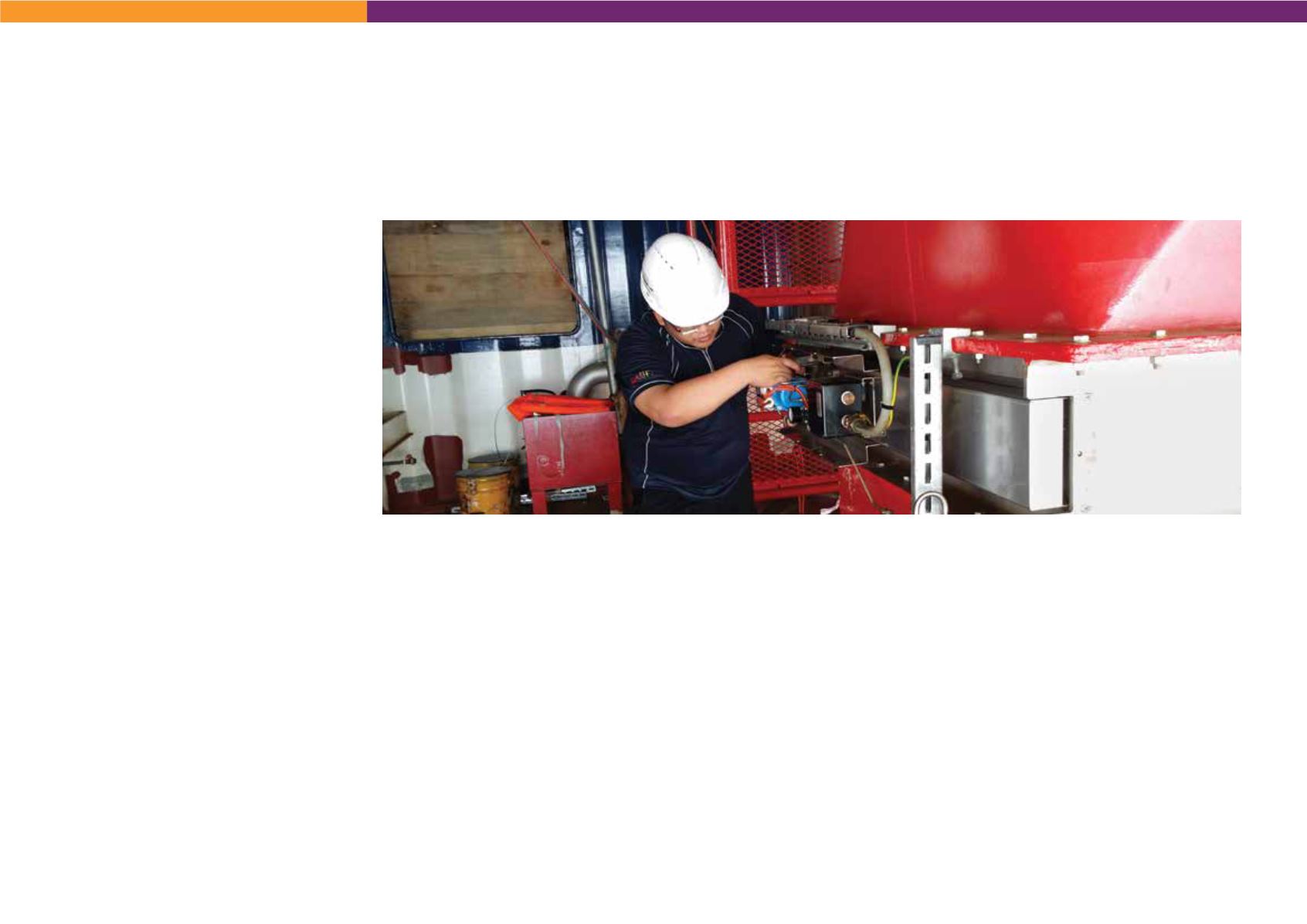

• Operating lease expenses amounting

to $1.2 million in FY2016 represents

an increase of $0.2 million from $1.0

million in FY2015. The increase is mainly

OPERATIONS

& BUSINESS REVIEW

attributable to rental of additional

storage and logistics facilities for the

Marine & Offshore segment.

Finance costs increased by $0.5 million from

$0.8 million in FY2015 to $1.3 million in

FY2016, even though loans and borrowings

decreased by $18.8 million from $62.5

million in FY2015 to $43.7 million in FY2016.

The Group redeemed loanswith outstanding

amounts totalling $10.5 million as at 30 June

2015, at the end of March 2016 following the

Group’s disposal of its leasehold property

at 47 Tuas Avenue 9. Thus, the effect of

reduction in finance costs arising from the

redemption of these loans was for a period

of only 3 months in FY2016. As a result of

the redemption of these loans, the Group

also incurred a loan prepayment fee of $0.1

million that was recognised as finance cost.

In addition, short-term interest rates have

increased during the financial year.

Income tax expense

In FY2016, the Group recorded an income

tax expense of $0.2 million, similar to that

incurred in FY2015.

Loss for the year

The Group recorded a loss for the year of

$23.8 million for FY2016 as compared to a

loss of $7.7 million in FY2015.