60

TEHO INTERNATIONAL INC LTD.

Annual Report 2016

NOTES

TO THE FINANCIAL STATEMENTS

Year ended 30 June 2016

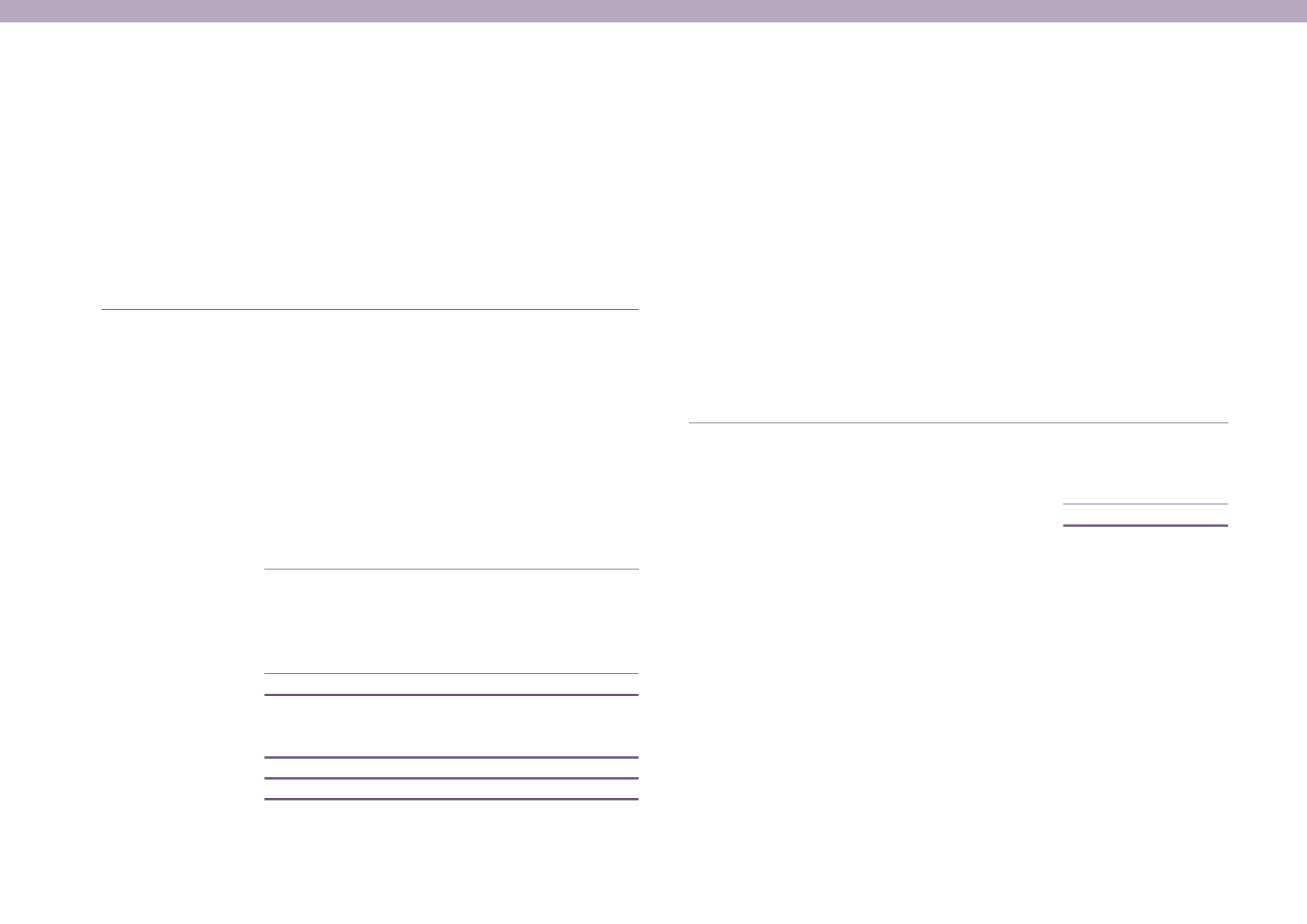

4 PROPERTY, PLANTAND EQUIPMENT (CONT’D)

Leasehold Plant and Motor Asset under

Note buildings machinery vehicles construction Total

$

$

$

$

$

Group

Accumulated depreciation and impairment loss:

At 1 July 2014

43,657 2,970,172 446,207

– 3,460,036

Depreciation

799,087 644,112 117,792

– 1,560,991

Disposals/Written off

– (19,576) (136,345)

– (155,921)

Elimination of

depreciation on

revaluation

(771,207)

–

–

– (771,207)

Effects of movements

in exchange rates

– 39,410

–

– 39,410

At 30 June 2015

71,537 3,634,118 427,654

– 4,133,309

Depreciation

718,593 857,468 140,809

– 1,716,870

Disposals/Written off

(153,488) (890,117)

(33,576)

– (1,077,181)

Effects of movements

in exchange rates

– 4,797

–

–

4,797

At 30 June 2016

636,642 3,606,266 534,887

– 4,777,795

Net book value:

At 1 July 2014

29,679,625 1,785,715 161,457

– 31,626,797

At 30 June 2015

35,651,945 2,272,820 573,375 275,983 38,774,123

At 30 June 2016

21,886,840 1,990,224 364,089

– 24,241,153

The leasehold buildings are pledged as security for banking facilities (Note 16).

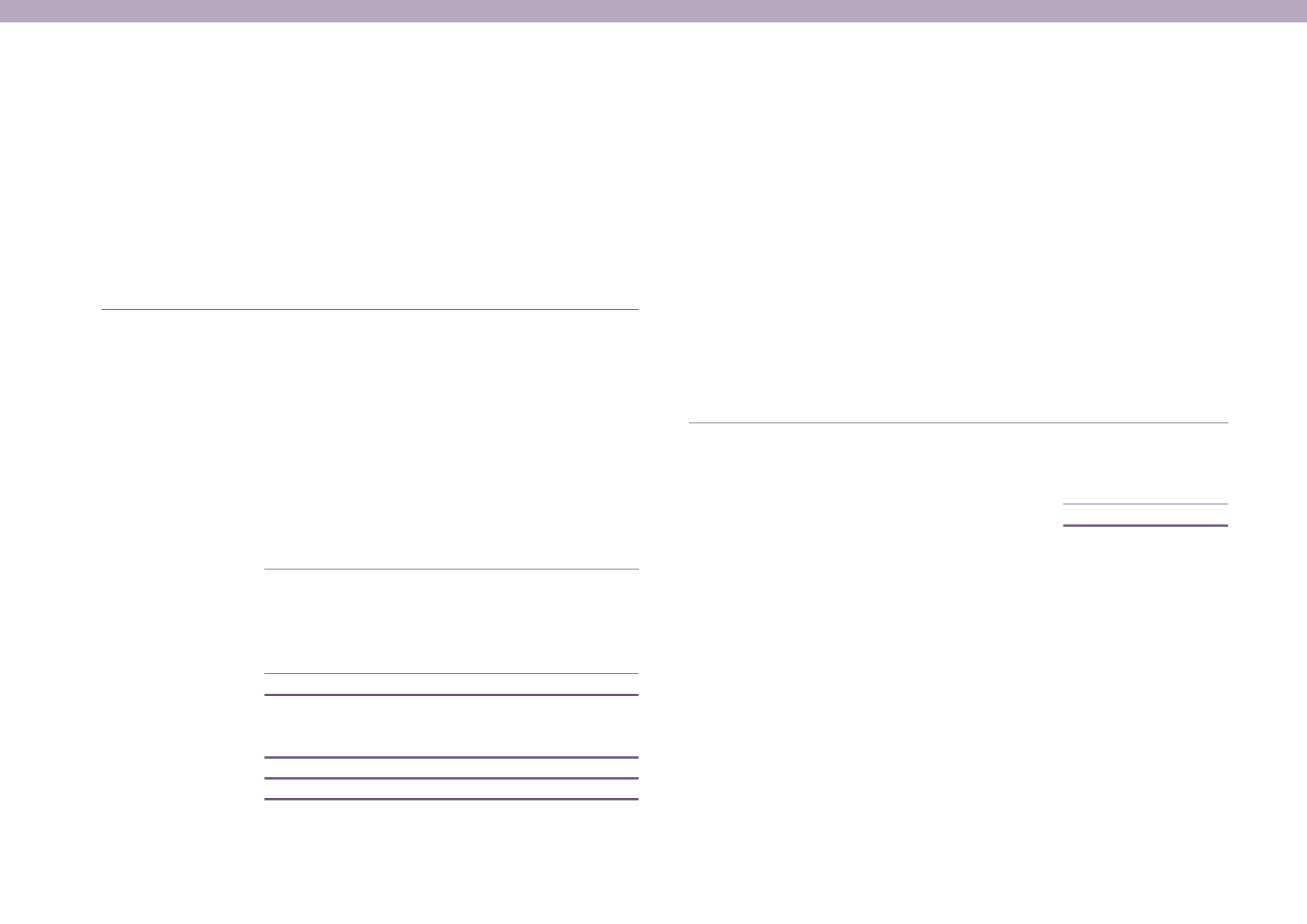

4 PROPERTY, PLANTAND EQUIPMENT (CONT’D)

The depreciation expense is charged to profit or loss and included in other operating

expenses.

For each revalued class of property, plant and equipment, the carrying amount that would

have been recognised had the assets been carried under the cost model is as follows:

Group

2016

2015

$

$

Leasehold buildings:

Cost

9,285,713 12,685,713

Accumulated depreciation

(2,506,714) (4,426,215)

Net book value

6,778,999 8,259,498

Independent valuers were sourced to determine the fair values of the Group’s leasehold

properties at least once every three years based on the properties’ highest and best use.

As at 30 June 2015 and 2016, the fair values of the leasehold warehouses and leasehold

ramp-up factory unit were based on valuations carried out by an independent valuer.

Measurement of fair values

(i)

Fair value hierarchy

The fair value measurement for the leasehold buildings has been categorised

as Level 2 fair value based on the inputs to the valuation techniques used (see

Note 2.4).