62

TEHO INTERNATIONAL INC LTD.

Annual Report 2016

NOTES

TO THE FINANCIAL STATEMENTS

Year ended 30 June 2016

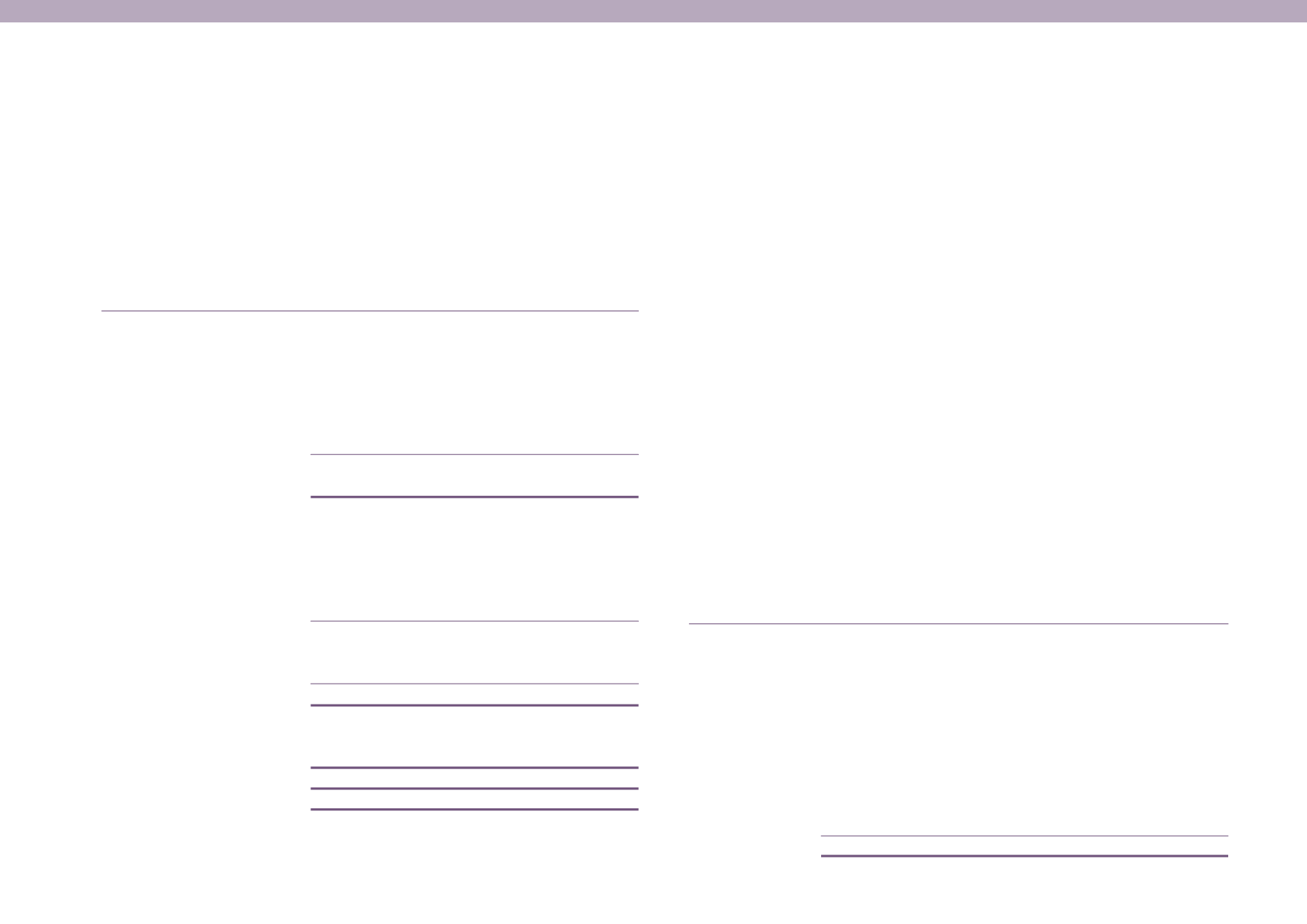

5 INTANGIBLEASSETS

Customer

Note Goodwill relationships Orderbook Total

$

$

$

$

Group

Cost

At 1 July 2014

8,376,540 2,605,000 705,000 11,686,540

Acquisitions through

business combinations 28 12,475,753

–

– 12,475,753

At 30 June 2015

and 30 June 2016

20,852,293 2,605,000 705,000 24,162,293

Accumulated amortisation

and impairment losses

At 1 July 2014

– 951,000 705,000 1,656,000

Amortisation

– 521,000

– 521,000

Impairment loss

2,209,048

–

– 2,209,048

At 30 June 2015

2,209,048 1,472,000 705,000 4,386,048

Amortisation

– 521,000

– 521,000

Impairment loss

16,931,227

–

– 16,931,227

At 30 June 2016

19,140,275 1,993,000 705,000 21,838,275

Carrying amounts

At 1 July 2014

8,376,540 1,654,000

– 10,030,540

At 30 June 2015

18,643,245 1,133,000

– 19,776,245

At 30 June 2016

1,712,018 612,000

– 2,324,018

The amortisation expense is charged to profit or loss and included in other operating

expenses.

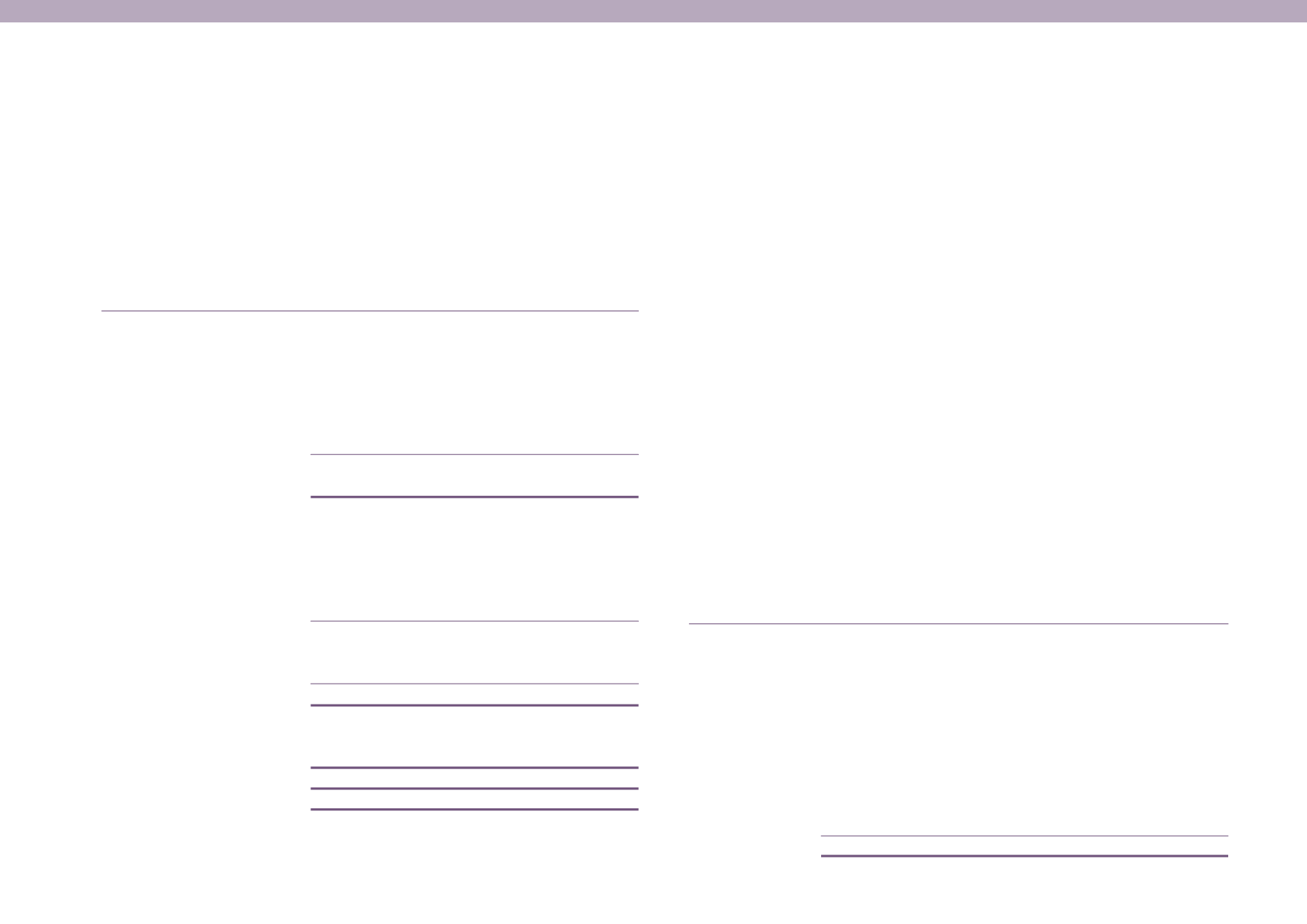

5 INTANGIBLEASSETS (CONT’D)

Impairment test

The goodwill arose from acquisitions of certain subsidiaries (see below). The value of

the goodwill is determined through purchase price allocation valuations carried out by

the management and independent professional valuers, as appropriate, for separate

acquisitions of subsidiaries.

An assessment is made annually whether goodwill has suffered any impairment loss.

The assessment process is complex and highly judgmental and is based on assumptions

that are affected by expected future market or economic conditions. Judgement is

required in identifying the cash generating units (“CGU”) and the use of estimates.

Goodwill is allocated to CGUs for the purpose of impairment testing. This CGU represents

the Group’s investment in the following subsidiaries. The goodwill is allocated to the

segments as follows:

2016

2015

Marine Property

Marine Property

& Offshore Development

& Offshore Development

Segment Segment Total

Segment

Segment

Total

$

$

$

$

$

$

Group

Name of subsidiaries:

TEHO Engineering

Pte. Ltd.

1,115,562

– 1,115,562 2,515,562

– 2,515,562

TEHO Water &

Envirotec Pte. Ltd.

–

–

– 844,364

– 844,364

TIEC Holdings Pte. Ltd.

– 596,456 596,456

– 2,807,566 2,807,566

ECG Property

Services Pte. Ltd.

–

–

–

– 12,475,753 12,475,753

1,115,562 596,456 1,712,018 3,359,926 15,283,319 18,643,245