81

TEHO INTERNATIONAL INC LTD.

Annual Report 2016

NOTES

TO THE FINANCIAL STATEMENTS

Year ended 30 June 2016

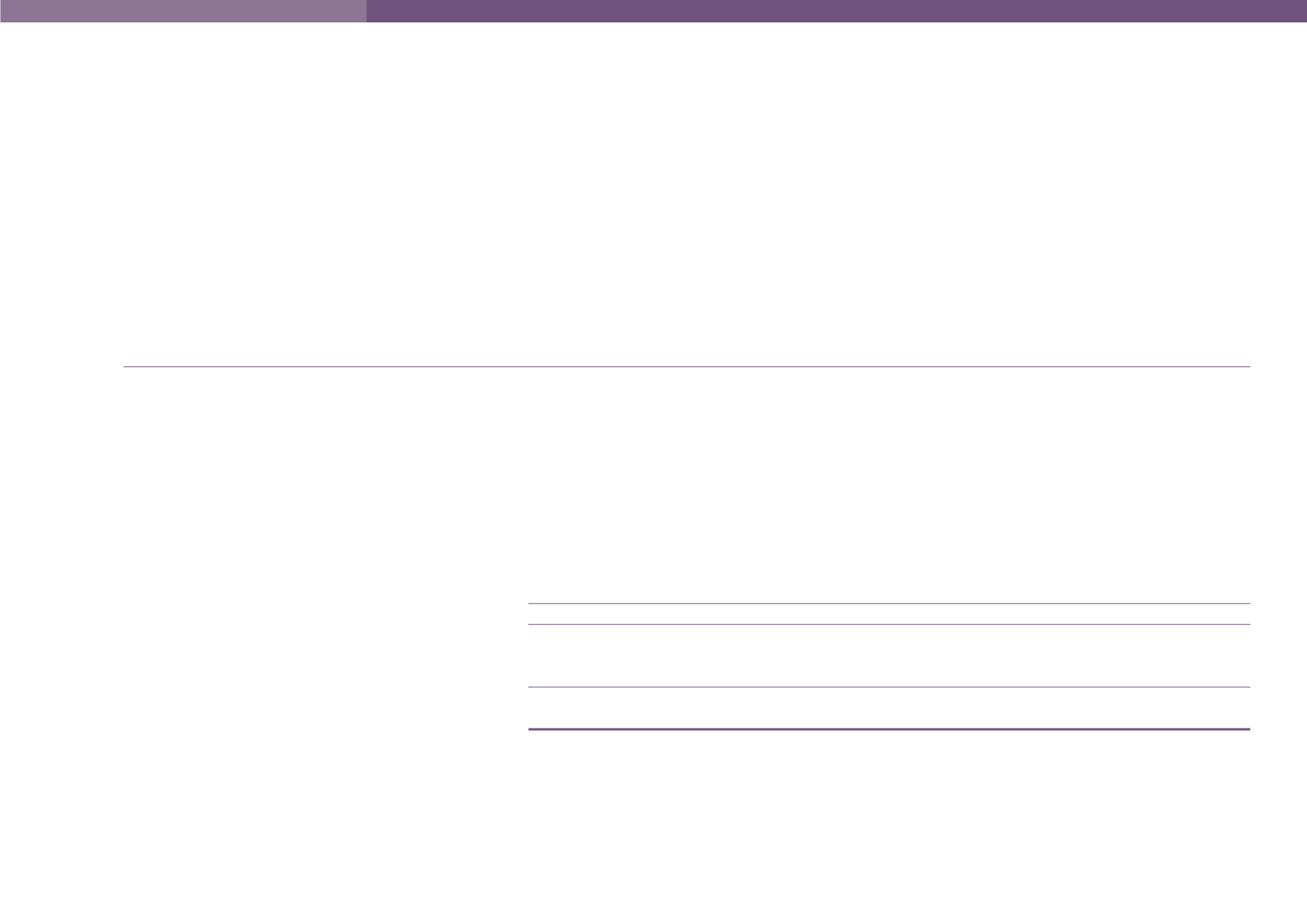

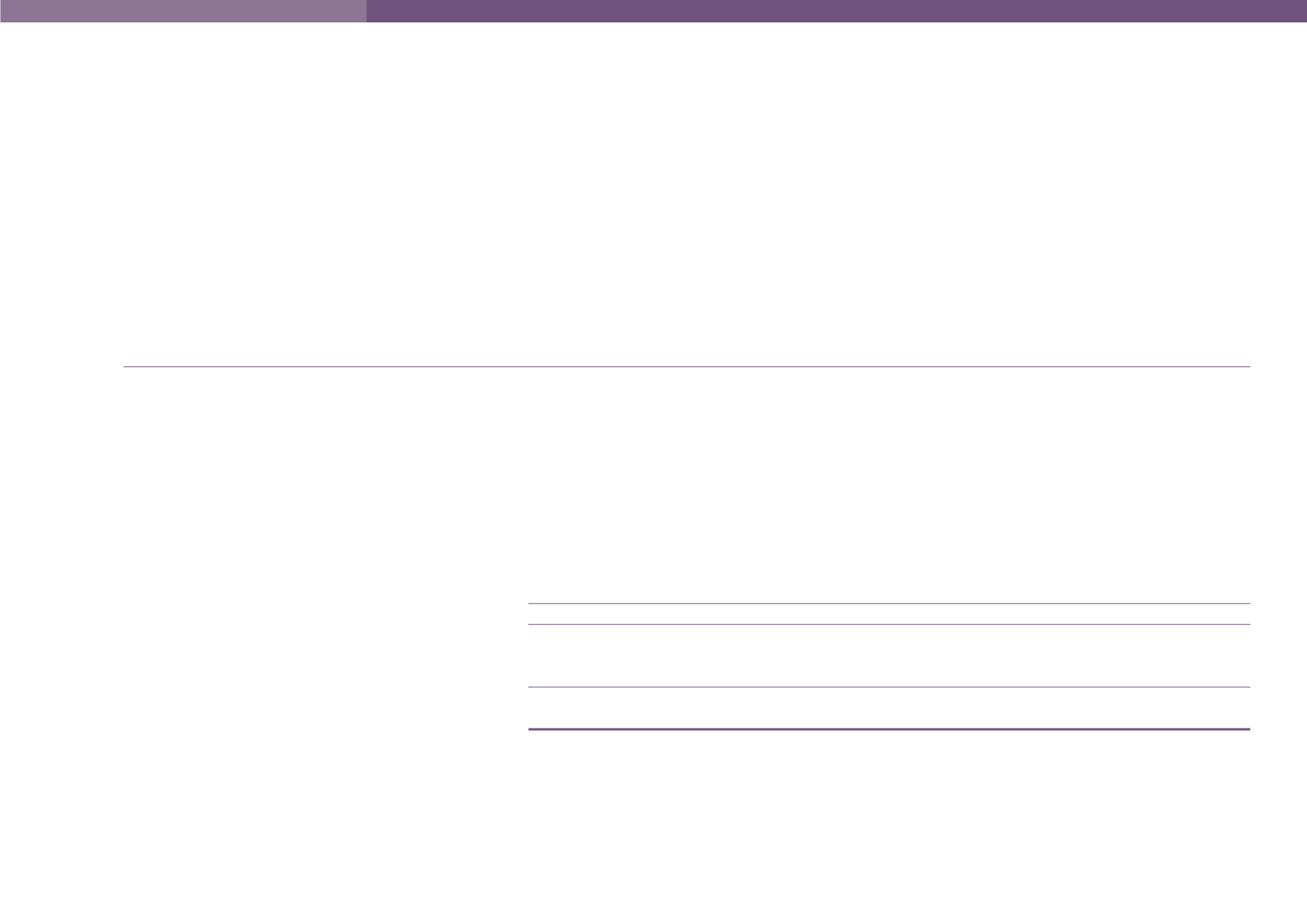

19 DEFERREDTAX LIABILITIES (CONT’D)

Recognised

in the statement

At

Recognised of comprehensive

Credited

Acquisition of

At

1 July

in profit or loss

income

directly to equity subsidiaries

30 June

2015

(note 23)

(note 23)

(note 23)

(note 28)

2016

$

$

$

$

$

$

Group

Deferred tax liabilities

Property, plant and equipment

95,642

(16,686)

–

–

–

78,956

Gain on property revaluation

4,656,716

–

–

(2,088,383)

–

2,568,333

Intangible assets

181,220

(77,180)

–

–

–

104,040

Adjustment in relation to development properties

119,000

–

–

–

–

119,000

Development properties based on stage of completion method

585,598

(675,571)

–

–

–

(89,973)

Profit recognised on development properties based on

stage of completion method

43,853

–

–

–

–

43,853

5,682,029

(769,437)

–

(2,088,383)

–

2,824,209

Deferred tax assets

Unutilised capital allowance

(225,001)

–

–

–

–

(225,001)

Total

5,457,028

(769,437)

–

(2,088,383)

–

2,599,208