84

TEHO INTERNATIONAL INC LTD.

Annual Report 2016

NOTES

TO THE FINANCIAL STATEMENTS

Year ended 30 June 2016

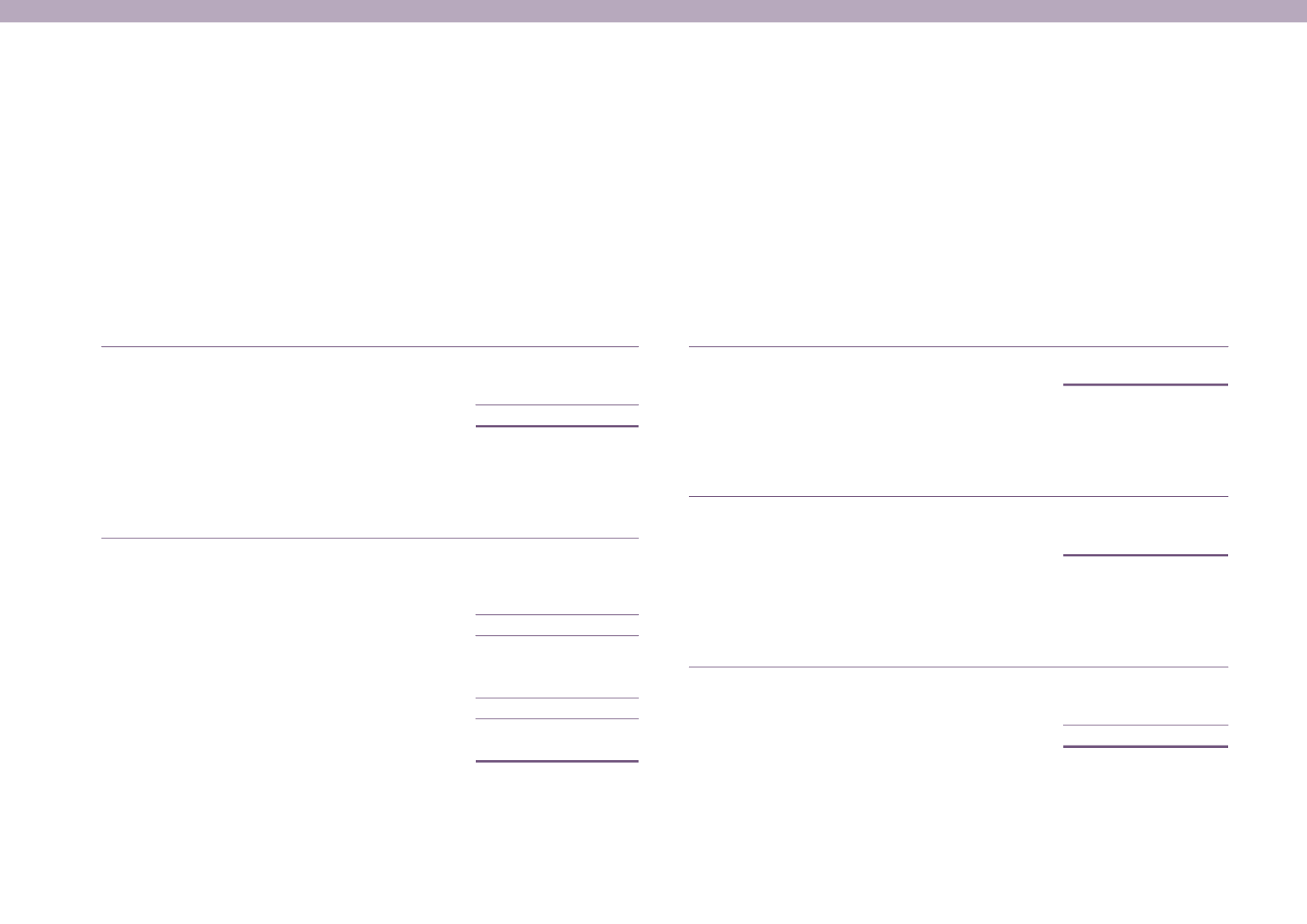

22 LOSS FORTHEYEAR (CONT’D)

Employee benefits expense

Group

2016

2015

$

$

Salaries, bonuses and other costs

10,795,024 8,574,669

Contributions to defined contribution plans

1,021,281

729,306

11,816,305 9,303,975

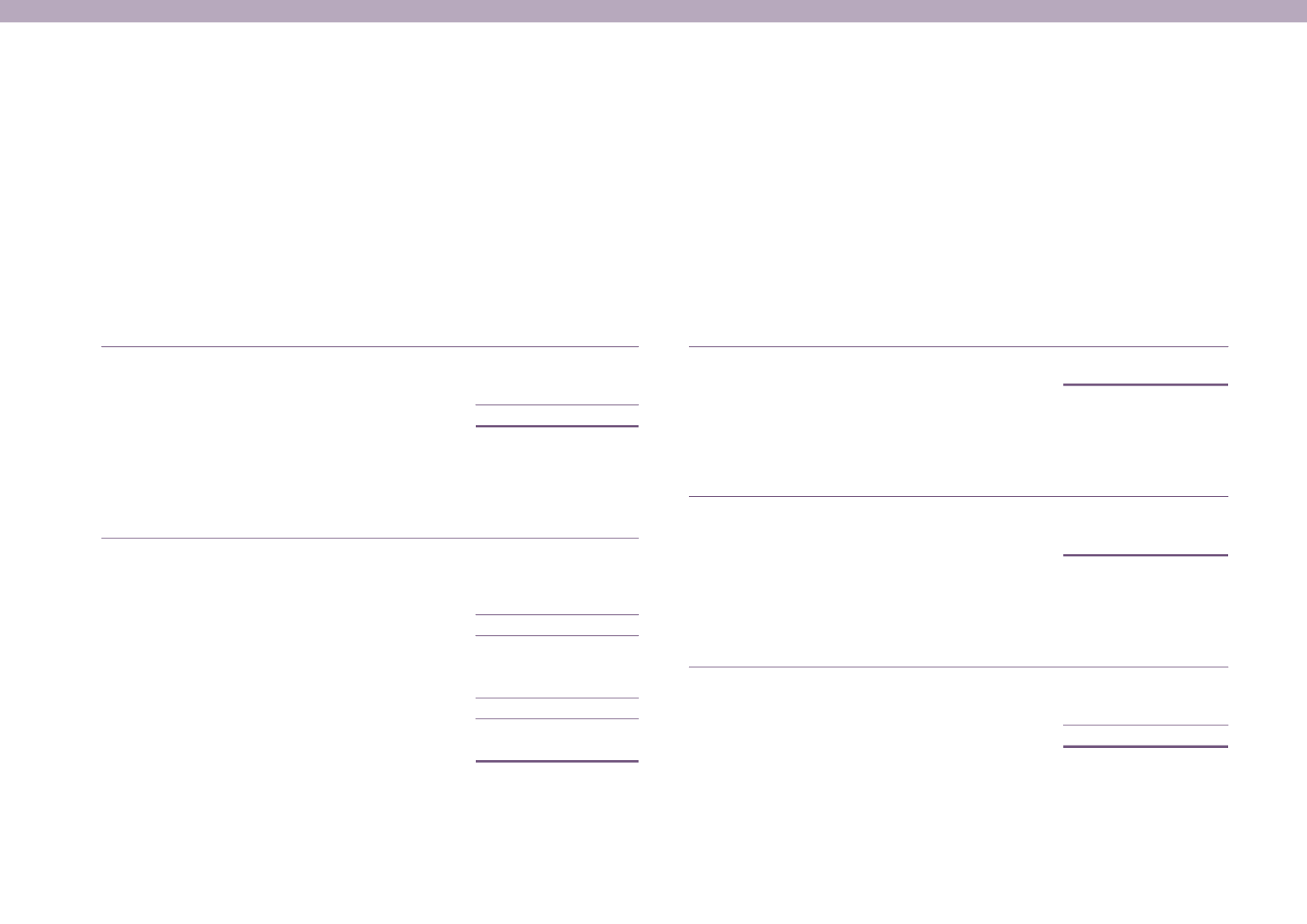

23 TAX EXPENSE

Group

2016

2015

Tax recognised in profit or loss

$

$

Current tax expense

Current year

949,307

369,740

Adjustment for prior periods

(11,785)

34,854

937,522 404,594

Deferred tax credit

Origination and reversal of temporary differences

(675,637)

(184,741)

Adjustment for prior periods

(93,800)

12,293

(769,437)

(172,448)

Total tax expense

168,085

232,146

23 TAX EXPENSE (CONT’D)

Deferred tax expense recognised in other comprehensive income:

Group

2016

2015

$

$

Gains on property revaluation

– 505,106

Deferred tax income credited directly to equity:

Group

2016

2015

$

$

Deferred tax income related to transfer of revaluation

reserve to retained earnings

(2,088,383)

(113,464)

Reconciliation of effective tax rate

Group

2016

2015

$

$

Loss before tax

(23,661,572) (7,456,501)

Share of loss from associates

–

51,212

(23,661,572) (7,405,289)