92

TEHO INTERNATIONAL INC LTD.

Annual Report 2015

NOTES TO THE

FINANCIAL STATEMENTS

Year ended 30 June 2015

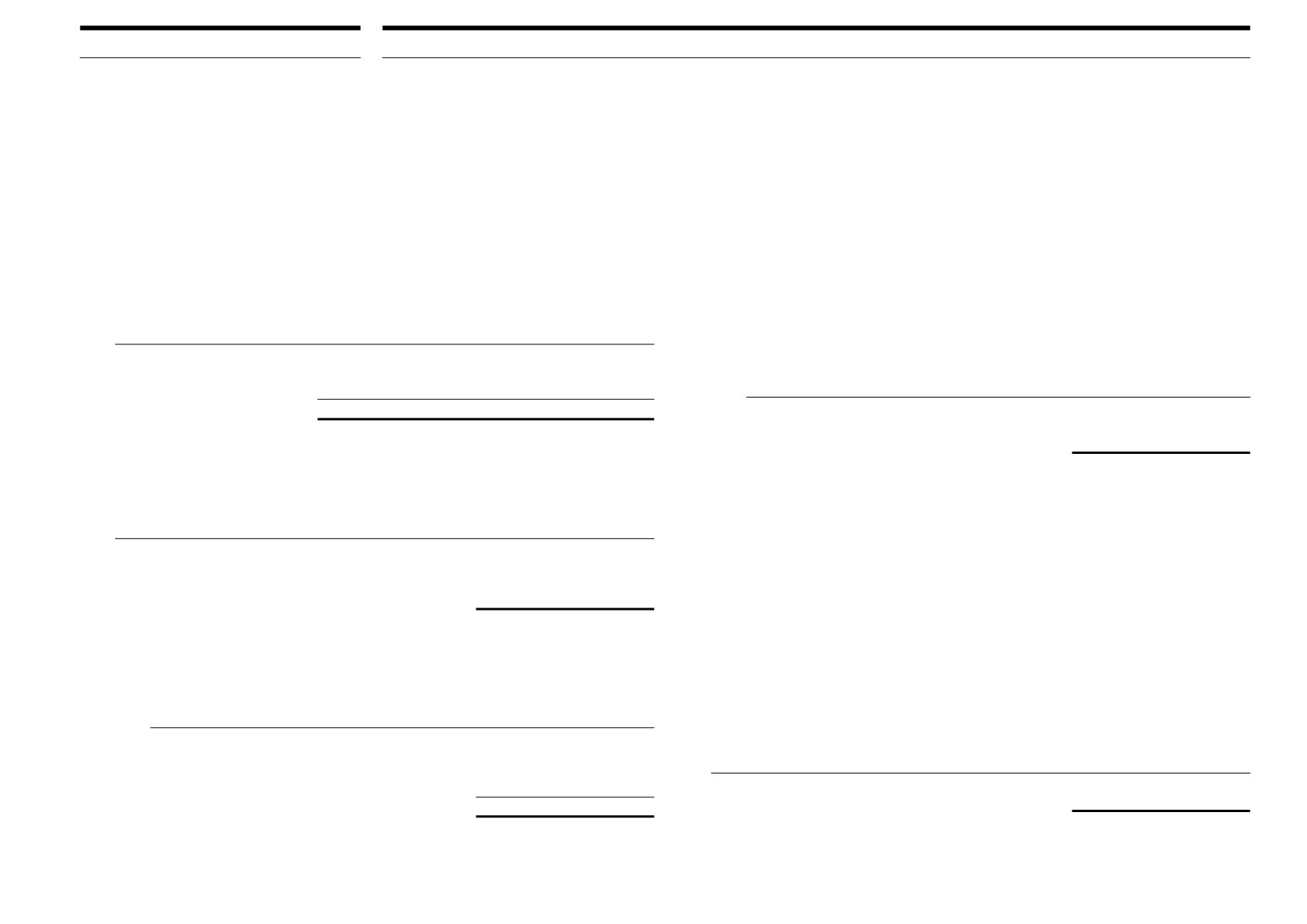

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Credit risk on financial assets (cont’d)

Group

Company

2015

2014

2015

2014

$

$

$

$

Marine, offshore oil & gas

13,660,267 12,252,224 5,646,128 4,917,454

Property development

3,417,074 4,112,400 24,312,198 1,500,000

17,077,341 16,364,624 29,958,326 6,417,454

The concentration of trade receivables by top 3 significant customers as at the end of

financial year is as follows:

Group

2015

2014

$

$

Top 1 customer

2,279,778 3,485,000

Top 2 customers

2,847,129 4,211,449

Top 3 customers

3,381,875 4,875,477

(a) Ageing analysis of the age of trade receivable amounts (unsecured) that are past due

as at the end of financial year but not impaired:

Group

2015

2014

$

$

Past due 1 to 60 days

5,273,488 5,288,093

Past due 61 to 90 days

787,427

905,916

Past due over 90 days

1,900,148 2,317,976

Total

7,961,063 8,511,985

The Group believes that the above amounts are still collectible in full, based on

historic payment behaviour and extensive analyses of customer credit risk, including

underlying customers’ credit ratings, when available.

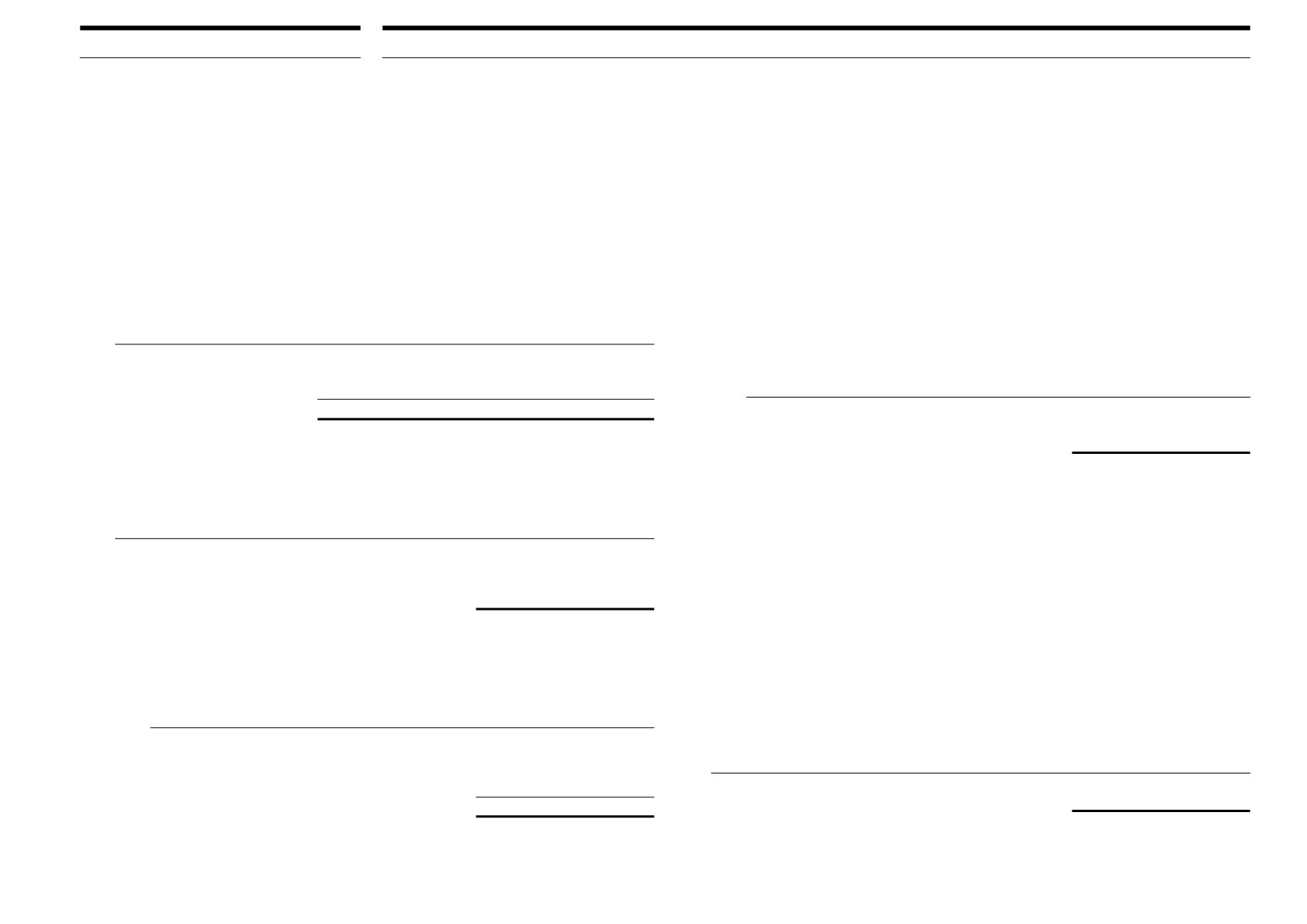

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Credit risk on financial assets (cont’d)

(b) Ageing analysis as at the end of financial year of trade receivable amounts that are

impaired:

Group

2015

2014

$

$

Trade receivables:

Past due over 90 days

418,180

20,809

The allowance which is disclosed in the Note 10 is based on individual accounts

totalling $418,180 (2014: $20,809) that are determined to be impaired at the end of

the financial year. These are not secured.

Other receivables are normally with no fixed terms and therefore there is no maturity.

Liquidity risk

Liquidity risk refers to the difficulty in meeting obligations associated with financial liabilities

that are settled by delivering cash or another financial asset. The Group maintains sufficient

cash and cash equivalents, and internally generated cash flows to finance its operations.

The Group finances liquidity through internally generated cash flows and minimises liquidity

risk by keeping committed credit lines available.

Group

2015

2014

$

$

Undrawn borrowing facilities

22,698,797

33,022,578

The undrawn borrowing facilities are available for operating activities and to settle other

commitments. Borrowing facilities are maintained to ensure funds are available for the

Group’s operations.