99

Annual Report 2015

TEHO INTERNATIONAL INC LTD.

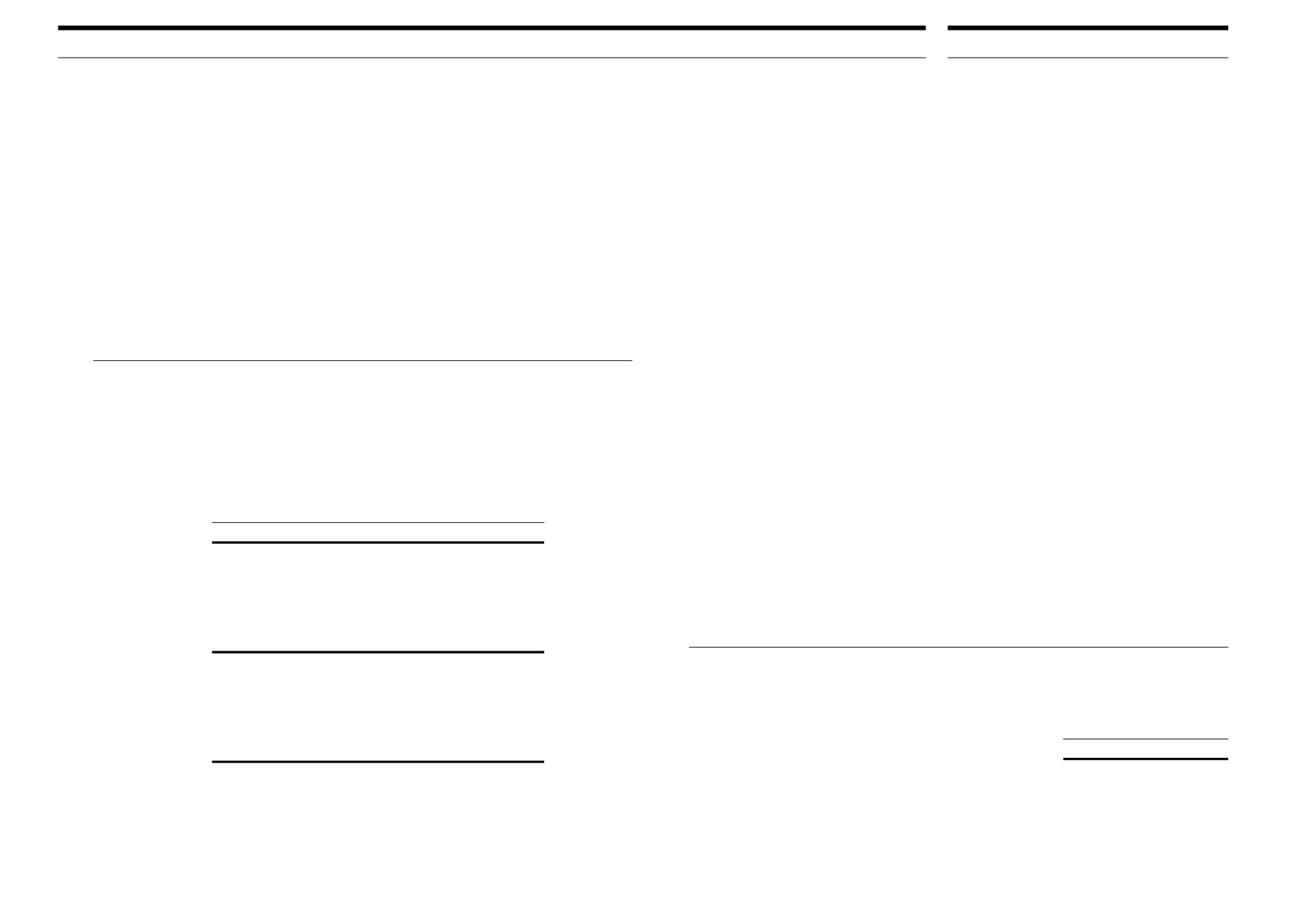

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Other

financial

Designated liabilities

Loans and

at

at amortised

receivables fair value

cost

Total

Level 2

$

$

$

$

$

Company

30 June 2014

Financial assets not

measured at fair value

Cash and cash

equivalents

168,285

–

–

168,285

Trade and other

receivables*

6,417,454

–

– 6,417,454

6,585,739

–

– 6,585,739

Financial liabilities

measured at fair value

Contingent

consideration

payable

–

723,000

–

723,000

723,000

Financial liabilities

not measured

at fair value

Trade and other

payables

#

–

– 13,798,814 13,798,814

* Excludes prepayments

#

Excludes derivatives and contingent consideration payable (shown separately) and advance

receipts from customers.

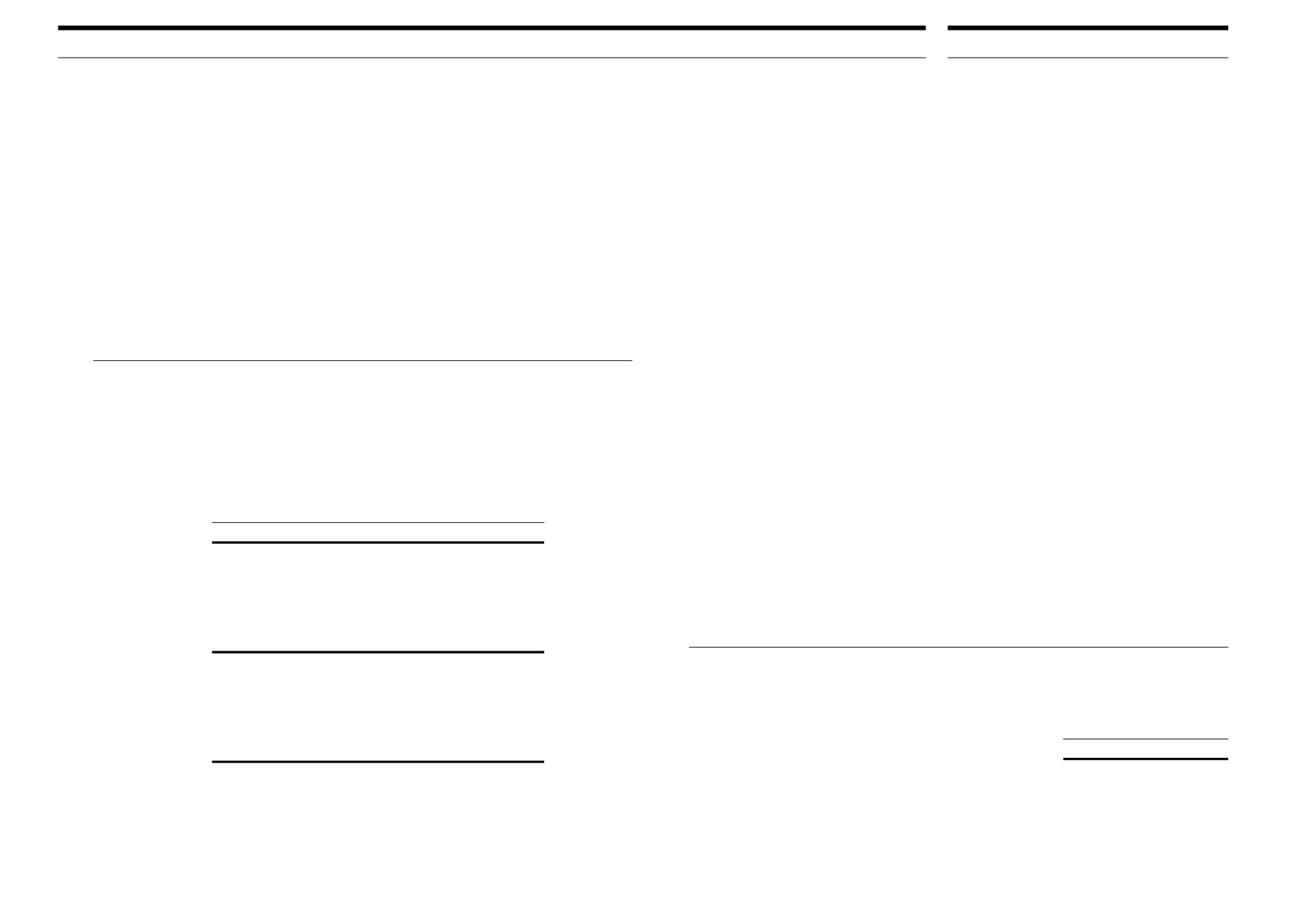

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

A description of the valuation techniques and the significant other observable inputs used

in the fair value measurement are as follows:

Type

Valuation technique

Derivative financial liabilities

Market comparison technique:

The fair values are

based on broker quotes. Similar contracts are traded

in an active market and the quotes reflect the actual

transactions in similar instruments.

Contingent consideration

payable

Income approach based on the expected payment

amount and their associated probabilities (i.e.

probability-weighted). When appropriate, it is

discounted to present value.

Loan due from/(to) a subsidiary Discounted cash flows.

29 COMMITMENTS

The Group have the following commitment as at the reporting date:

Group

2015

2014

$

$

Development expenditure contracted for development

properties but not provided for in the financial statements 8,880,517 6,675,855

Expenditure contracted for property, plant and equipment

but not provided for in the financial statements

1,339,005

–

10,219,522 6,675,855

In addition, as part of the provisions of an agreement entered into between a subsidiary

and a non-controlling interest, the Group will bear all costs relating to or in any way

connected with the design, planning, project manangement, supervision, conduct, launch,

marketing and promotion of “The Bay” project and the operation of the subsidiary, other

than construction costs, sales agency commission and the relevant developer charges.

NOTES TO THE

FINANCIAL STATEMENTS

Year ended 30 June 2015