97

Annual Report 2015

TEHO INTERNATIONAL INC LTD.

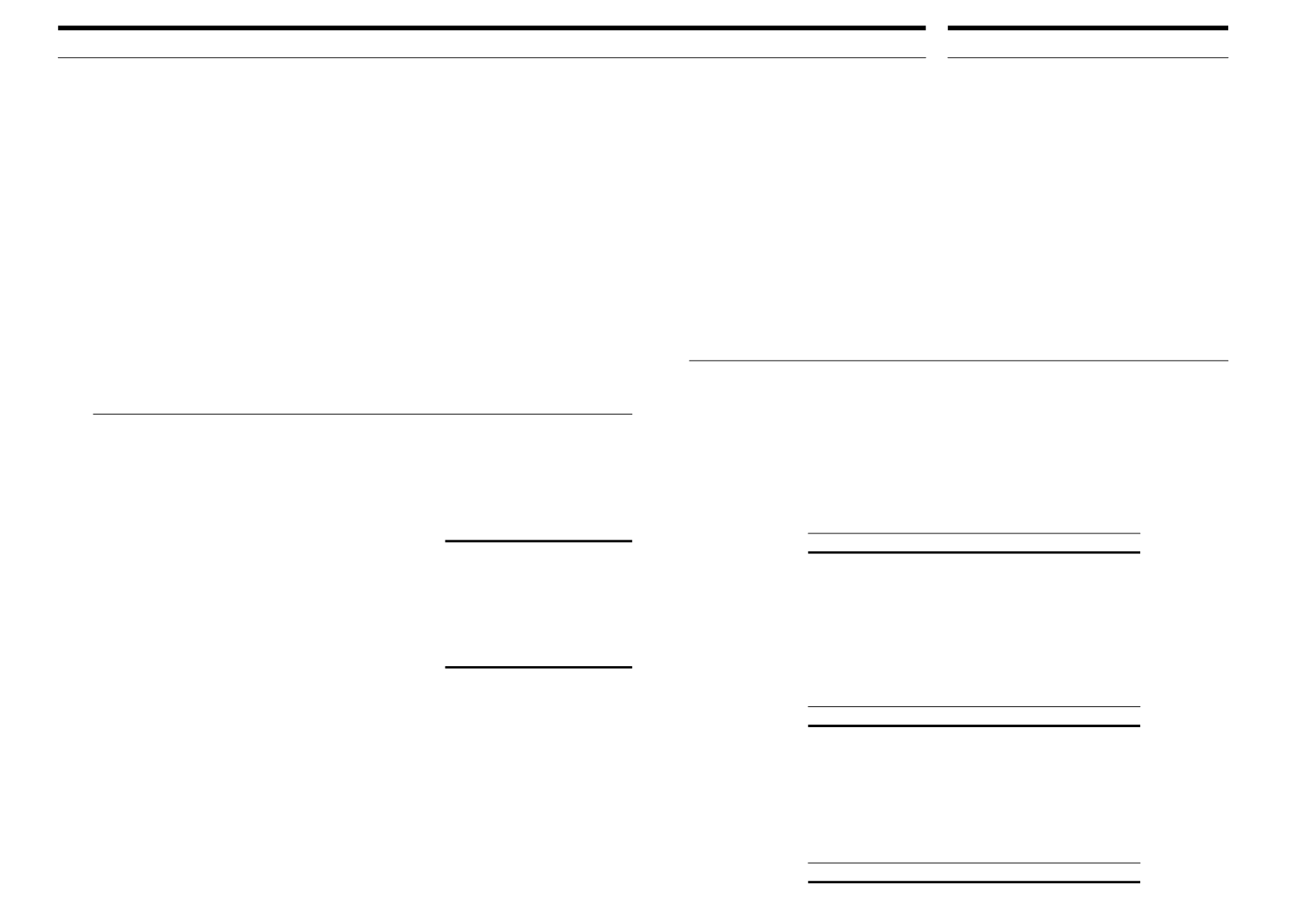

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Foreign currency risk (cont’d)

Sensitivity analysis (cont’d)

Group

Profit

Other

or loss before comprehensive

tax

income

$

$

30 June 2015

USD (10% strengthening)

215,467

7,843

USD (10% weakening)

(215,467)

(7,843)

EUR (10% strengthening)

14,334

168,576

EUR (10% weakening)

(14,334)

(168,576)

30 June 2014

USD (10% strengthening)

337,109

30,015

USD (10% weakening)

(337,109)

(30,015)

EUR (10% strengthening)

30,015

176,638

EUR (10% weakening)

(30,015)

(176,638)

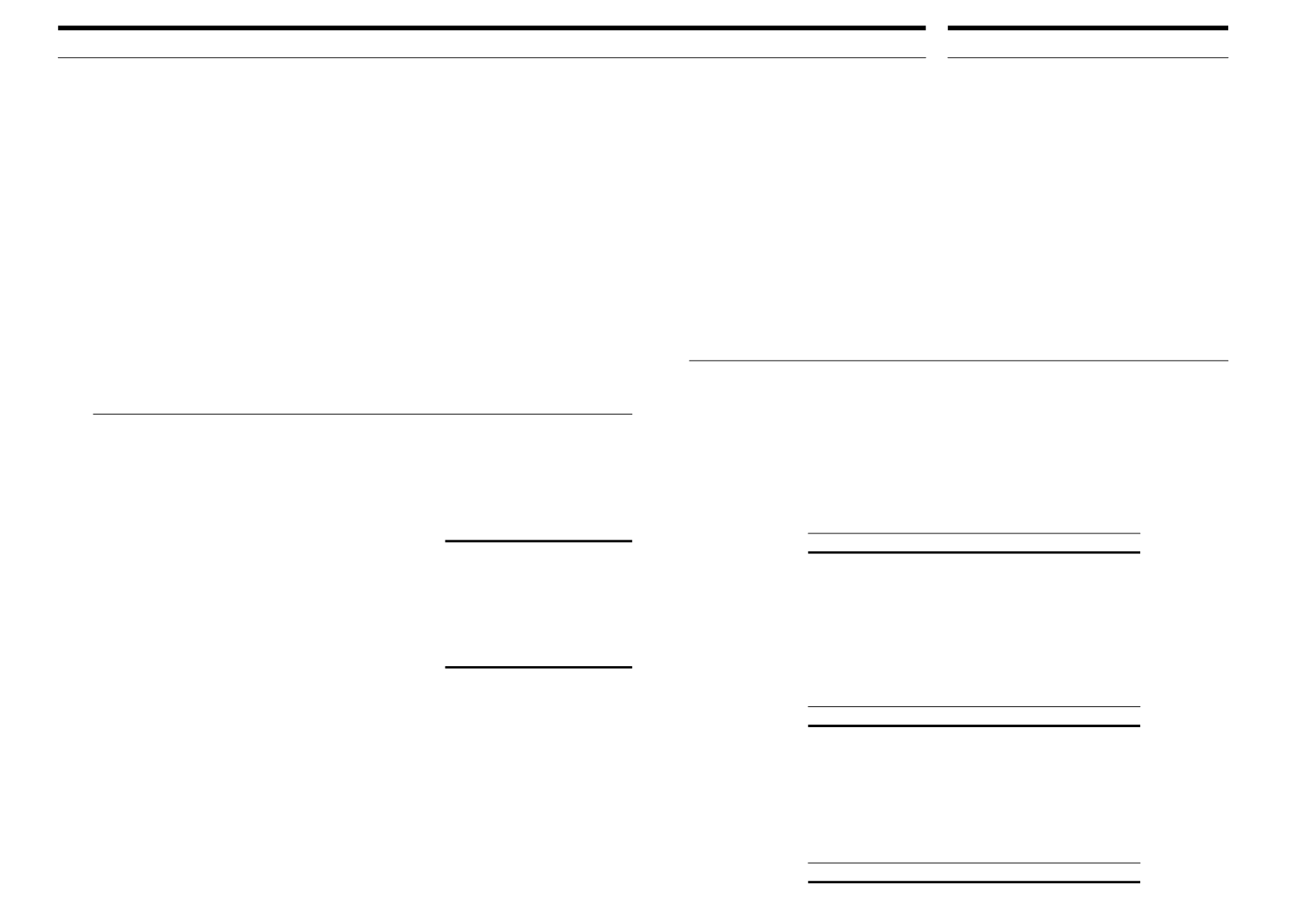

Classification of Financial Assets and Liabilities and Fair Values

The carrying amounts and fair values of financial assets and financial liabilities, including

their levels in the fair value hierarchy are as follows. It does not include fair value information

for financial assets and financial liabilities not measured at fair value if the carrying amount

is a reasonable approximation of fair value.

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Other

financial

Designated liabilities

Loans and

at

at amortised

receivables fair value

cost

Total

Level 2

$

$

$

$

$

Group

30 June 2015

Financial assets not

measured at

fair value

Cash and cash

equivalents

13,744,705

–

– 13,744,705

Trade and other

receivables*

17,077,341

–

– 17,077,341

30,822,046

–

– 30,822,046

Financial liabilities

measured at

fair value

Derivatives

financial liabilities

–

360,241

–

360,241

360,241

Contingent

consideration

payable

–

78,924

–

78,924

78,924

–

439,165

–

439,165

Financial liabilities not

measured at fair value

Fixed rate loan

–

– 1,846,693 1,846,693 1,826,627

Other loans and

borrowings

–

– 60,686,711 60,686,711

Trade and other

payables

#

–

– 7,719,181 7,719,181

–

– 70,252,585 70,252,585

NOTES TO THE

FINANCIAL STATEMENTS

Year ended 30 June 2015