93

Annual Report 2015

TEHO INTERNATIONAL INC LTD.

NOTES TO THE

FINANCIAL STATEMENTS

Year ended 30 June 2015

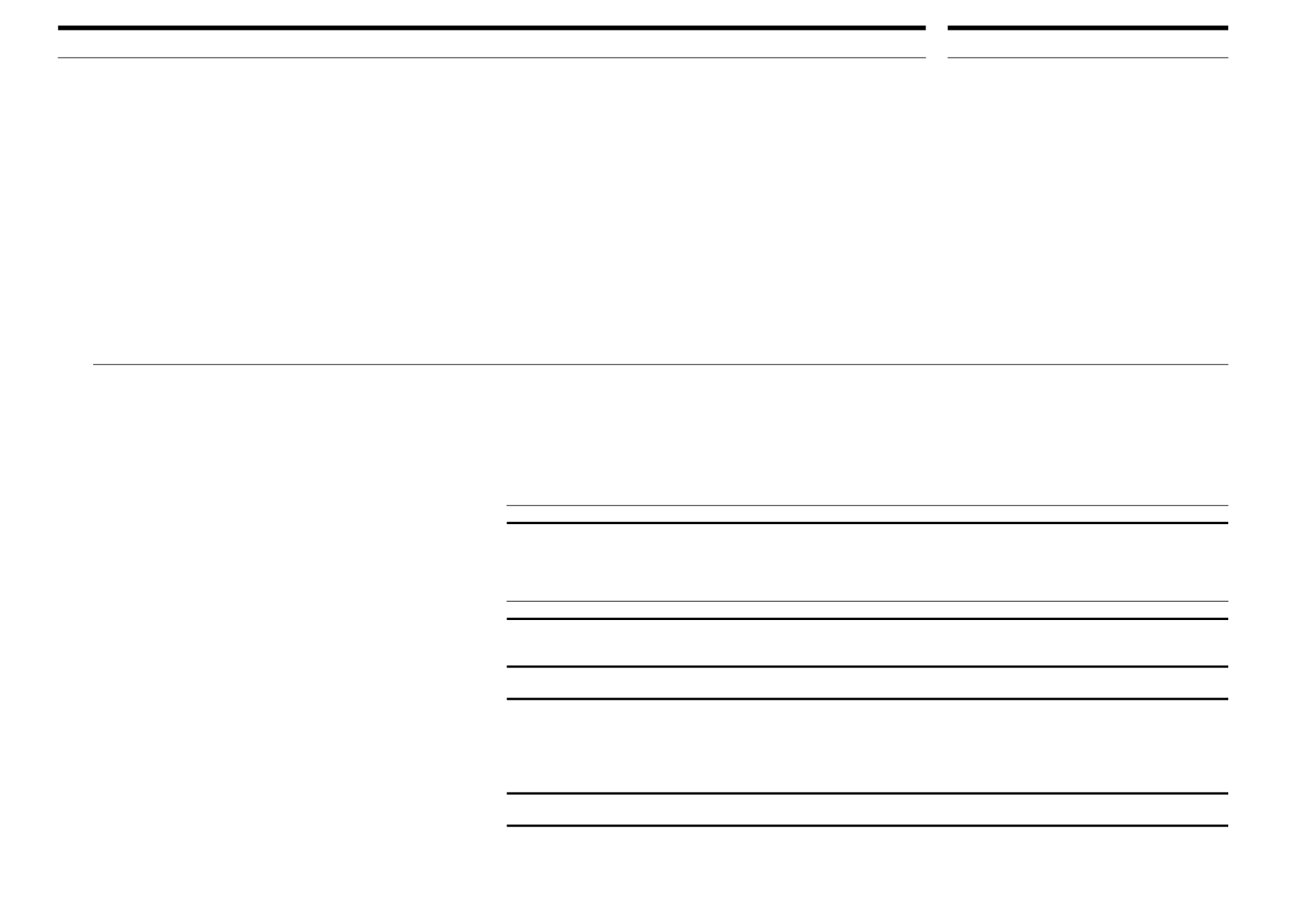

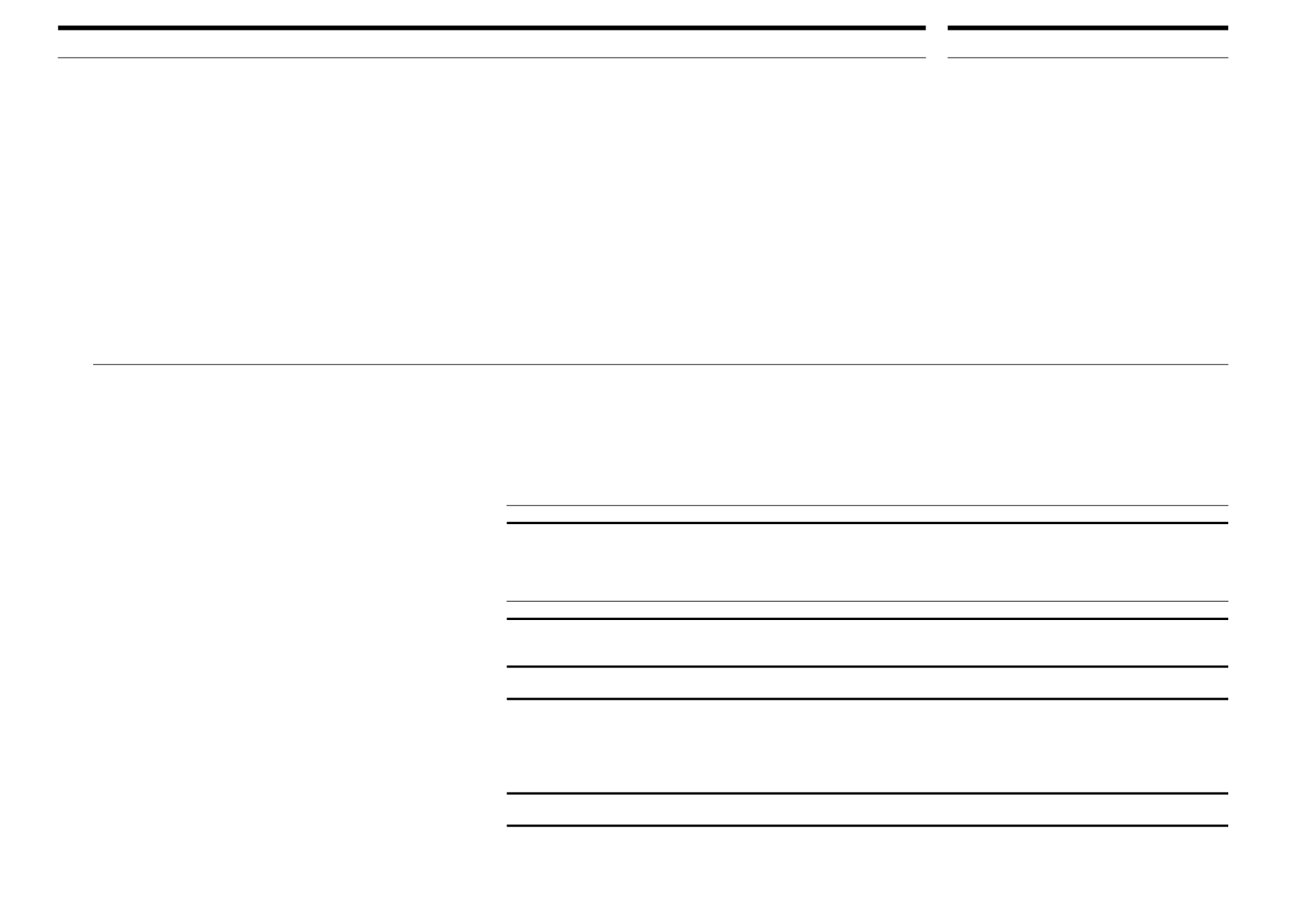

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Liquidity risk (cont’d)

The following are the contractual maturities of financial liabilities, including estimated interest payments and excluding the impact of netting agreements:

Carrying

Contractual

Less than

1 – 5

Over

amount

cash flows

1 year

years

5 years

$

$

$

$

$

Group

Non-derivative financial liabilities

30 June 2015

Secured bank loans

55,384,746

(59,448,310)

(27,037,063)

(28,669,059)

(3,742,188)

Finance lease liabilities

197,455

(206,076)

(144,897)

(61,179)

–

Trust receipts

6,951,203

(6,951,203)

(6,951,203)

–

–

Trade and other payables*

7,468,422

(7,468,422)

(7,468,422)

–

–

70,001,826

(74,074,011)

(41,601,585)

(28,730,238)

(3,742,188)

30 June 2014

Secured bank loans

41,884,454

(43,021,597)

(21,112,315)

(21,331,511)

(577,771)

Finance lease liabilities

286,065

(294,104)

(168,036)

(126,068)

–

Trust receipts

6,952,973

(6,952,973)

(6,952,973)

–

–

Trade and other payables*

7,653,584

(7,653,584)

(7,653,584)

–

–

56,777,076

(57,922,258)

(35,886,908)

(21,457,579)

(577,771)

Derivative financial liabilities

30 June 2015

Net settled: Structured currency instruments

360,241

(360,241)

(360,241)

–

–

30 June 2014

Net settled: Structured currency instruments

376,525

(376,525)

(376,525)

–

–

Company

Non-derivative financial liabilities

30 June 2015

Trade and other payables

30,798,477

(31,435,689)

(29,672,356)

(1,763,333)

–

30 June 2014

Trade and other payables

14,521,814

(14,521,814)

(14,521,814)

–

–

* Excludes derivatives (shown separately) and advance receipts from customers.