95

Annual Report 2015

TEHO INTERNATIONAL INC LTD.

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Interest rate risk (cont’d)

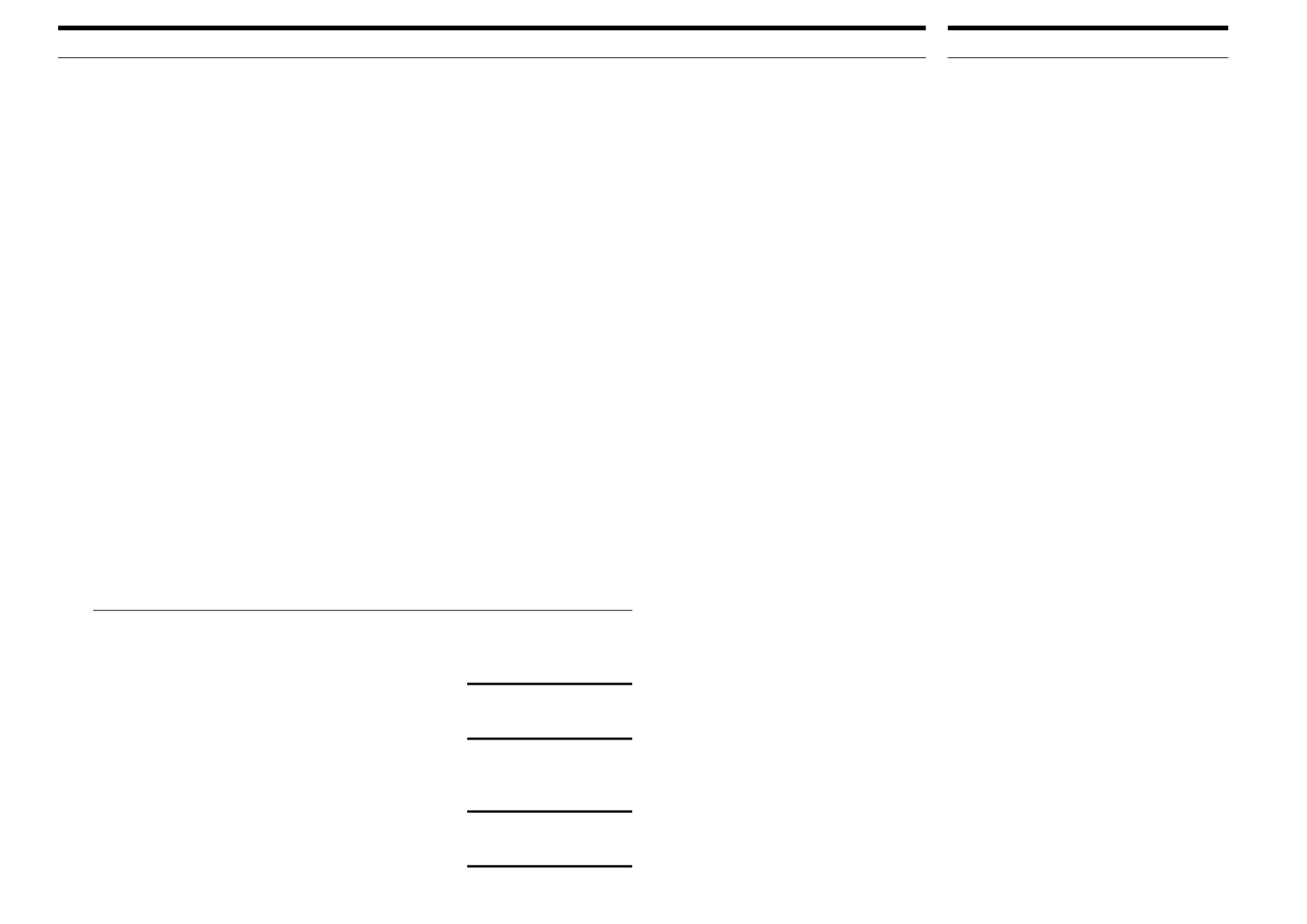

Sensitivity analysis for fixed rate instruments

The Group does not account for any fixed rate financial assets and liabilities at fair value

through profit or loss. Therefore a change in interest rates at the reporting date would not

affect profit or loss.

Sensitivity analysis for variable rate instruments

The variable rate debt obligations are with interest rates that are re-set regularly at one,

three or six month intervals. A change of 100 basis points in interest rates at the reporting

date would have increased/(decreased) equity and profit or loss before tax by the amounts

shown below. There is no impact on other components of equity. This analysis assumes

that all other variables, in particular foreign currency rates, remain constant.

Profit or loss before tax

100 bp

100 bp

increase

decrease

$

$

Group

30 June 2015

Variable rate instruments

(398,247)

398,247

30 June 2014

Variable rate instruments

(260,931)

260,931

Company

30 June 2015

Variable rate instruments

1,458

(1,458)

30 June 2014

Variable rate instruments

1,683

(1,683)

28 FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

Foreign currency risk

Foreign currency risk refers to the risk that the fair value of future cash flows of a financial

instrument will fluctuate because of changes in foreign exchange rates. The Group is

exposed to foreign currency risk on sales, purchases and borrowings, including inter-

company sales, purchases and inter-company balances that are denominated in a currency

other than the respective functional currencies of Group entities. The currencies in which

these transactions primarily are denominated are the Singapore dollar (SGD), US dollar

(USD) and Euro (EUR).

Interest on borrowings is denominated in the currency of the borrowing. Generally,

borrowings are denominated in currencies that match the cash flows generated by the

underlying operations of the Group, primarily SGD, but also USD and EUR. This provides

an economic hedge without derivatives being entered into and therefore hedge accounting

is not applied in these circumstances.

In respect of other monetary assets and liabilities denominated in foreign currencies, the

Group’s policy is to ensure that its net exposure is kept to an acceptable level by buying or

selling foreign currencies at spot rates when necessary to address short-term imbalances.

The Company has a number of investments in foreign subsidiaries whose net assets are

exposed to currency translation risk. The Group does not currently designate its foreign

currency denominated debt as a hedging instrument for the purpose of hedging the

translation of its foreign operations.

NOTES TO THE

FINANCIAL STATEMENTS

Year ended 30 June 2015